“The U.S. Unemployment Rate: An In-Depth Analysis

Related Articles The U.S. Unemployment Rate: An In-Depth Analysis

- Solana Gains Traction: A Deep Dive Into The High-Performance Blockchain

- Secure Your Network from Advanced Persistent Threats: Detection and Response

- The Cornerstone Of Progress: Examining National Education Standards And Their Impact

- The Looming Crisis: Understanding And Addressing The Teacher Shortage

- Essential Endpoint Threat Monitoring for Enhanced Security

Introduction

On this special occasion, we are happy to review interesting topics related to The U.S. Unemployment Rate: An In-Depth Analysis. Let’s knit interesting information and provide new insights to readers.

The U.S. Unemployment Rate: An In-Depth Analysis

The unemployment rate is a vital economic indicator that reflects the health and stability of the labor market in the United States. It measures the percentage of the labor force that is currently unemployed but actively seeking employment. Understanding the nuances of the unemployment rate is crucial for policymakers, economists, and individuals alike, as it provides valuable insights into the overall economic conditions and potential challenges that lie ahead.

Definition and Calculation

The U.S. Bureau of Labor Statistics (BLS) is responsible for calculating and reporting the unemployment rate on a monthly basis. The labor force consists of individuals aged 16 and older who are either employed or actively seeking employment. To be considered unemployed, individuals must meet the following criteria:

- They are not currently employed.

- They have actively looked for work in the past four weeks.

- They are currently available for work.

The unemployment rate is calculated by dividing the number of unemployed individuals by the total labor force and multiplying by 100 to express it as a percentage.

Types of Unemployment

Unemployment is not a monolithic phenomenon, and economists typically categorize it into several types, each with its own underlying causes and implications:

-

Frictional Unemployment: This type of unemployment arises from the natural turnover in the labor market. It occurs when individuals are transitioning between jobs, searching for better opportunities, or entering the workforce for the first time. Frictional unemployment is generally considered a healthy aspect of a dynamic economy, as it allows workers to find jobs that better match their skills and preferences.

-

Structural Unemployment: Structural unemployment occurs when there is a mismatch between the skills and qualifications of workers and the requirements of available jobs. This can be caused by technological advancements, shifts in industry demand, or changes in the global economy. Structural unemployment often requires workers to acquire new skills or relocate to areas with greater job opportunities.

-

Cyclical Unemployment: Cyclical unemployment is directly related to the business cycle. It rises during economic downturns and recessions as businesses reduce their workforce due to decreased demand for goods and services. Cyclical unemployment is a major concern for policymakers, as it can lead to significant economic hardship and social unrest.

-

Seasonal Unemployment: Seasonal unemployment is caused by fluctuations in employment that occur regularly throughout the year. Industries such as agriculture, tourism, and retail often experience seasonal variations in employment demand.

Factors Influencing the Unemployment Rate

The unemployment rate is influenced by a wide range of factors, including:

-

Economic Growth: Strong economic growth typically leads to increased job creation and a lower unemployment rate. Conversely, economic slowdowns or recessions can result in job losses and a higher unemployment rate.

-

Government Policies: Government policies, such as fiscal stimulus, tax incentives, and regulations, can have a significant impact on the unemployment rate. Fiscal stimulus can boost demand and create jobs, while tax incentives can encourage businesses to invest and hire more workers.

-

Technological Advancements: Technological advancements can lead to both job creation and job displacement. While new technologies can create new industries and opportunities, they can also automate tasks previously performed by human workers, leading to job losses in certain sectors.

-

Globalization: Globalization has led to increased trade and investment flows, which can affect the unemployment rate in both positive and negative ways. Increased trade can create new export-oriented jobs, while competition from foreign firms can lead to job losses in domestic industries.

-

Demographic Trends: Demographic trends, such as population growth, aging, and migration, can also influence the unemployment rate. A growing population can increase the labor supply, while an aging population can lead to labor shortages in certain sectors.

Interpreting the Unemployment Rate

While the unemployment rate is a valuable indicator, it is important to interpret it with caution and consider its limitations. The unemployment rate does not capture the following:

-

Underemployment: Underemployment refers to individuals who are employed part-time but would prefer to work full-time, or those who are employed in jobs that do not fully utilize their skills and qualifications.

-

Discouraged Workers: Discouraged workers are individuals who have stopped actively seeking employment because they believe that no jobs are available for them.

-

Marginally Attached Workers: Marginally attached workers are individuals who are not currently in the labor force but would like to work and have looked for a job in the past 12 months.

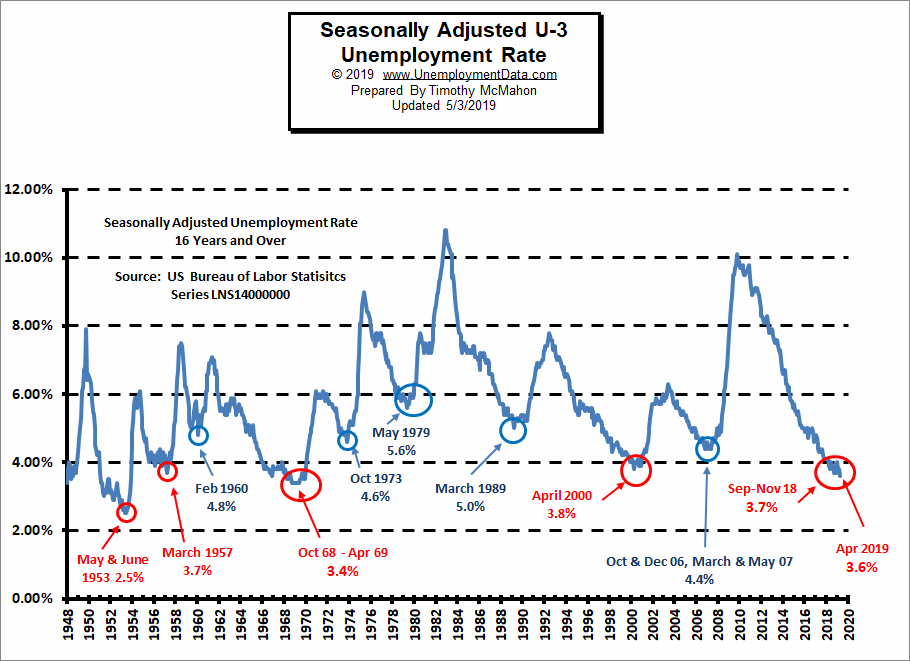

Historical Trends in the U.S. Unemployment Rate

The U.S. unemployment rate has fluctuated significantly over time, reflecting changes in economic conditions and government policies. Here are some notable historical trends:

-

The Great Depression: During the Great Depression of the 1930s, the unemployment rate soared to a peak of 24.9% in 1933.

-

World War II: World War II led to a dramatic decrease in the unemployment rate, as millions of Americans were mobilized for military service and war production.

-

The Post-War Era: The post-war era saw relatively low unemployment rates, with periods of economic expansion and prosperity.

-

The 1970s: The 1970s were marked by high inflation and unemployment, a phenomenon known as stagflation.

-

The 1980s and 1990s: The 1980s and 1990s saw a period of economic growth and declining unemployment rates.

-

The Great Recession: The Great Recession of 2008-2009 led to a sharp increase in the unemployment rate, which peaked at 10.0% in October 2009.

-

The Post-Recession Recovery: The post-recession recovery has been characterized by a gradual decline in the unemployment rate, although it has remained elevated compared to pre-recession levels.

-

The COVID-19 Pandemic: The COVID-19 pandemic caused a sharp and unprecedented spike in the unemployment rate, which reached 14.7% in April 2020.

The Unemployment Rate and Monetary Policy

The Federal Reserve (Fed), the central bank of the United States, closely monitors the unemployment rate as part of its dual mandate to maintain price stability and maximum employment. The Fed uses monetary policy tools, such as interest rate adjustments and quantitative easing, to influence the unemployment rate and inflation.

When the unemployment rate is high, the Fed may lower interest rates to stimulate economic activity and encourage businesses to hire more workers. Conversely, when the unemployment rate is low and inflation is rising, the Fed may raise interest rates to cool down the economy and prevent inflation from spiraling out of control.

The Unemployment Rate and Fiscal Policy

Fiscal policy, which involves government spending and taxation, can also be used to influence the unemployment rate. During economic downturns, the government may implement fiscal stimulus measures, such as tax cuts or increased government spending, to boost demand and create jobs.

Fiscal policy can be a powerful tool for addressing unemployment, but it can also lead to increased government debt and deficits.

The Future of the U.S. Unemployment Rate

The future of the U.S. unemployment rate is uncertain and will depend on a variety of factors, including the pace of economic growth, technological advancements, globalization, and government policies.

Some economists predict that the unemployment rate will continue to decline in the coming years as the economy continues to recover from the COVID-19 pandemic. However, others warn that the unemployment rate could rise again if the economy slows down or if there are further disruptions to the global economy.

Conclusion

The U.S. unemployment rate is a complex and multifaceted indicator that reflects the health and stability of the labor market. Understanding the nuances of the unemployment rate is crucial for policymakers, economists, and individuals alike, as it provides valuable insights into the overall economic conditions and potential challenges that lie ahead. While the unemployment rate is not a perfect measure of labor market conditions, it remains an important tool for assessing the state of the economy and informing policy decisions.

Disclaimer: This article is for informational purposes only and does not constitute financial or economic advice. Consult with a qualified professional before making any decisions based on the information provided herein.