“Okay, here’s a comprehensive article predicting and analyzing the potential US inflation rate in May 2025, aiming for approximately 1600 words.

Related Articles Okay, here’s a comprehensive article predicting and analyzing the potential US inflation rate in May 2025, aiming for approximately 1600 words.

- Stock Market Volatility: Understanding The Swings And Navigating The Uncertainty

- Student Loan Forgiveness: Will 2025 Be A Year Of Relief Or Renewal Of Uncertainty?

- Ripple Vs. SEC: June 15 Court Deadline And Its Implications

- Mastering Incident Response: A Guide to Mitigating Cyber Threats

- AI-Driven Surveillance: Concerns, Challenges, And The Erosion Of Privacy

Introduction

On this special occasion, we are happy to review interesting topics related to Okay, here’s a comprehensive article predicting and analyzing the potential US inflation rate in May 2025, aiming for approximately 1600 words.. Let’s knit interesting information and provide new insights to readers.

Table of Content

Okay, here’s a comprehensive article predicting and analyzing the potential US inflation rate in May 2025, aiming for approximately 1600 words.

US Inflation Rate: A Forecast and Analysis for May 2025

Predicting the future is never an exact science, especially when it comes to economic indicators like inflation. The US inflation rate is a complex metric influenced by a multitude of factors, ranging from global supply chains and geopolitical events to domestic fiscal and monetary policies. Forecasting the inflation rate for May 2025 requires a careful examination of these factors, current trends, and potential future scenarios. This article will delve into a detailed analysis of the potential US inflation rate in May 2025, considering various economic indicators, expert opinions, and possible risks.

Understanding the Current Landscape (Late 2023/Early 2024)

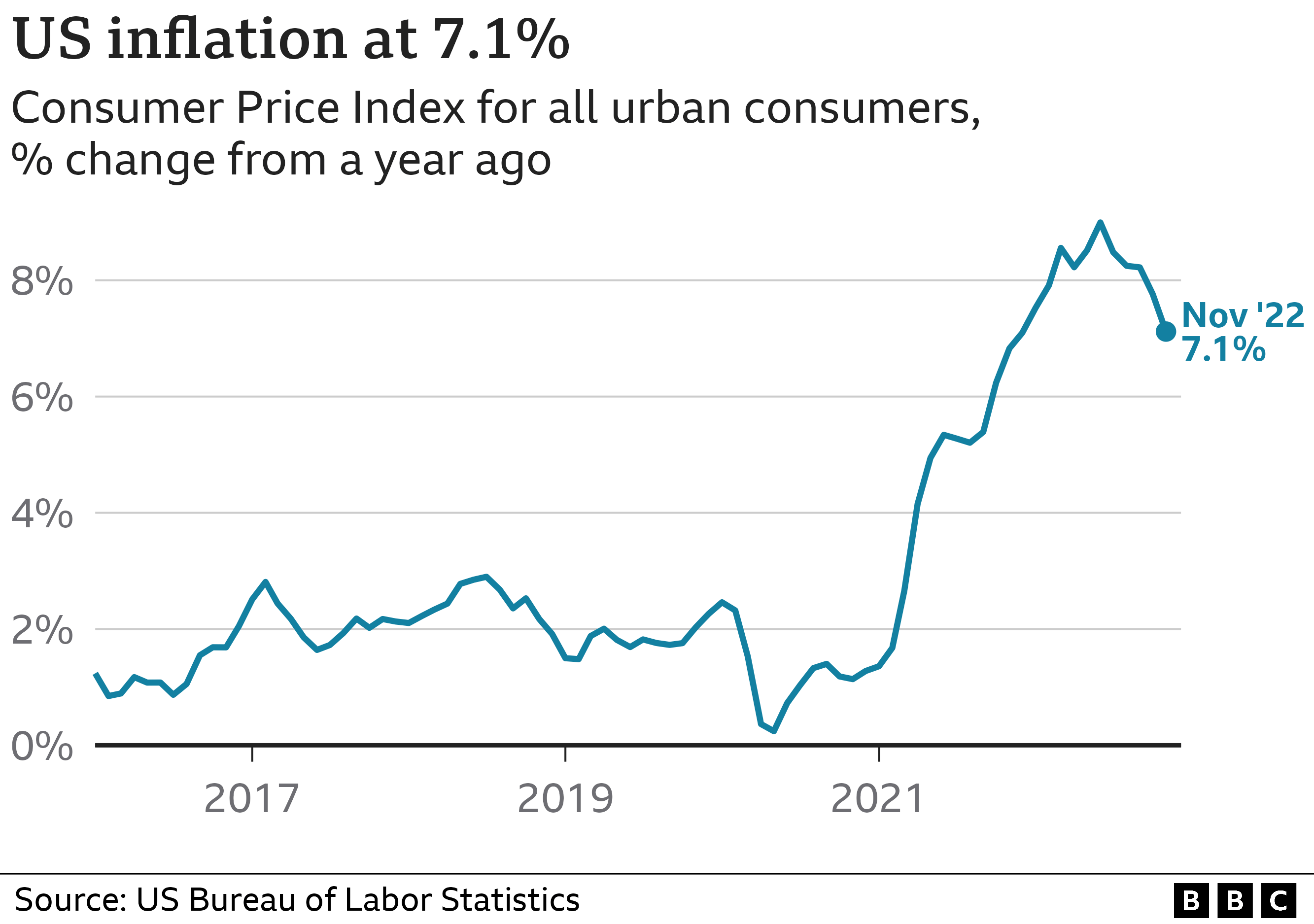

To accurately forecast the inflation rate for May 2025, it’s crucial to understand the economic environment leading up to that point. As of late 2023 and early 2024, the US economy has been navigating a period of moderating inflation after a surge in 2022 and early 2023. The Federal Reserve (the Fed) has been aggressively tightening monetary policy by raising the federal funds rate to combat inflation. This has resulted in higher borrowing costs for consumers and businesses, which has started to cool down demand in various sectors.

Key observations of this period include:

- Slowing Inflation: The Consumer Price Index (CPI) and the Personal Consumption Expenditures (PCE) price index, the Fed’s preferred inflation gauge, have shown a downward trend. However, inflation remains above the Fed’s target of 2%.

- Labor Market Resilience: The labor market has remained surprisingly strong, with low unemployment rates. This has contributed to wage growth, which can put upward pressure on prices.

- Supply Chain Improvements: Supply chain bottlenecks that plagued the economy in 2021 and 2022 have gradually eased, reducing some cost pressures.

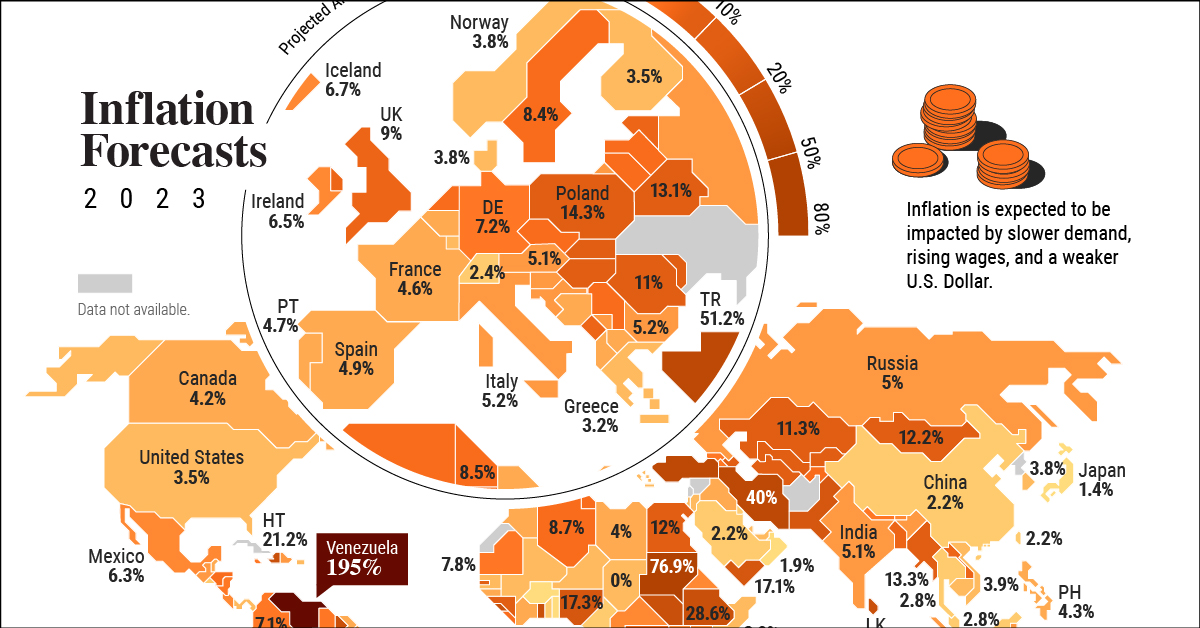

- Geopolitical Uncertainty: Ongoing geopolitical tensions, such as the war in Ukraine and tensions in other regions, continue to pose risks to global supply chains and energy prices.

- Fiscal Policy: Government spending and tax policies continue to play a role in shaping economic activity and influencing inflation.

Factors Influencing Inflation in 2024-2025

Several key factors will significantly influence the US inflation rate in the lead-up to May 2025:

-

Federal Reserve Policy: The Fed’s monetary policy decisions will be paramount. The central bank will likely continue to monitor inflation data closely and adjust interest rates accordingly. The critical question is whether the Fed will maintain its hawkish stance (keeping rates high) or pivot to a more dovish approach (cutting rates) if inflation continues to fall. The timing and magnitude of any rate cuts will have a significant impact on inflation.

-

Labor Market Dynamics: The strength of the labor market will be a crucial determinant of wage growth. If the labor market remains tight, wage pressures could persist, contributing to inflation. Conversely, if the labor market weakens, wage growth could slow, easing inflationary pressures. The participation rate, job openings, and unemployment claims will be closely watched indicators.

-

Supply Chain Resilience: While supply chains have improved, they remain vulnerable to disruptions. Geopolitical events, natural disasters, or other unforeseen circumstances could lead to renewed bottlenecks and higher prices. The ability of businesses to diversify supply chains and build resilience will be essential.

-

Energy Prices: Energy prices are a significant driver of inflation. Fluctuations in oil and natural gas prices can have a ripple effect throughout the economy, affecting transportation costs, manufacturing costs, and consumer spending. Geopolitical events, production decisions by OPEC+, and shifts in energy demand will all play a role.

-

Consumer Spending: Consumer spending accounts for a significant portion of US economic activity. Consumer confidence, disposable income, and borrowing costs will influence spending patterns. A slowdown in consumer spending could dampen demand and ease inflationary pressures.

-

Housing Market: The housing market is another critical sector. Rising mortgage rates have already cooled down the housing market, but the extent to which this slowdown will impact inflation remains to be seen. Rent inflation, which has been a significant contributor to overall inflation, will be closely watched.

-

Global Economic Conditions: The global economic outlook will also influence US inflation. A global recession could reduce demand for US exports and put downward pressure on prices. Conversely, strong global growth could boost demand and contribute to inflation.

-

Technological Advancements: Productivity gains resulting from technological advancements could help to offset wage pressures and keep inflation in check. Investments in automation, artificial intelligence, and other technologies could boost efficiency and reduce costs.

-

Government Policies: Government spending, tax policies, and regulations can all influence inflation. Expansionary fiscal policies (increased government spending or tax cuts) could stimulate demand and contribute to inflation, while contractionary policies could have the opposite effect. Regulatory changes can also impact costs and prices.

Potential Scenarios and Inflation Rate Forecasts for May 2025

Based on the factors discussed above, here are three potential scenarios for the US inflation rate in May 2025:

-

Scenario 1: The "Soft Landing" (Base Case)

- Assumptions: The Fed successfully navigates a soft landing, gradually bringing inflation down to its 2% target without triggering a recession. The labor market cools moderately, but remains relatively healthy. Supply chains remain stable, and energy prices are moderate.

- Inflation Rate Forecast: In this scenario, the US inflation rate (CPI) in May 2025 would likely be in the range of 2.3% to 2.8%. The Fed would have likely paused or even slightly lowered interest rates by this point, as inflation approaches the target.

-

Scenario 2: The "Stagflation" (Pessimistic Case)

- Assumptions: The Fed struggles to bring inflation down, and the economy experiences slow growth or even a recession. Supply chain disruptions persist, and energy prices spike due to geopolitical events. Wage growth remains elevated, contributing to a wage-price spiral.

- Inflation Rate Forecast: In this scenario, the US inflation rate (CPI) in May 2025 could be significantly higher, potentially in the range of 3.5% to 4.5%. The Fed would face a difficult choice between raising rates to combat inflation and supporting the struggling economy.

-

Scenario 3: The "Rapid Disinflation" (Optimistic Case)

- Assumptions: Supply chains improve dramatically, energy prices fall sharply, and consumer demand weakens significantly. The labor market cools rapidly, and wage growth slows substantially. The Fed aggressively cuts interest rates to support the economy.

- Inflation Rate Forecast: In this scenario, the US inflation rate (CPI) in May 2025 could fall below the Fed’s target, potentially in the range of 1.5% to 2.0%. The Fed would likely be concerned about deflation and would continue to ease monetary policy.

Risks to the Forecast

Several risks could significantly alter the inflation outlook:

- Geopolitical Shocks: Unexpected geopolitical events, such as an escalation of the war in Ukraine or a conflict in another region, could disrupt supply chains and send energy prices soaring.

- Pandemic Resurgence: A new variant of COVID-19 could lead to renewed lockdowns and supply chain disruptions.

- Policy Mistakes: Errors in monetary or fiscal policy could exacerbate inflation or trigger a recession.

- Financial Instability: A crisis in the financial sector could disrupt credit markets and trigger an economic downturn.

Expert Opinions

Forecasting inflation is a challenging task, and expert opinions often vary. Economists at major financial institutions and research organizations provide regular forecasts and analysis of the US economy. Consulting these sources can provide valuable insights into the range of possible outcomes. However, it’s important to remember that even the most sophisticated models and expert opinions are subject to uncertainty.

Conclusion

Predicting the US inflation rate for May 2025 is inherently uncertain. The actual inflation rate will depend on a complex interplay of factors, including Federal Reserve policy, labor market dynamics, supply chain resilience, energy prices, consumer spending, and global economic conditions. While the base case scenario suggests that inflation will likely be in the range of 2.3% to 2.8%, the risks are tilted to the upside, given the potential for geopolitical shocks, supply chain disruptions, and policy mistakes. Monitoring key economic indicators and staying informed about expert opinions will be crucial for understanding the evolving inflation outlook. Investors and businesses should prepare for a range of possible scenarios and adjust their strategies accordingly. The future of inflation remains a key concern for the US economy, and its trajectory will shape the economic landscape for years to come.