“Flood Insurance Updates: What You Need to Know in 2024

Related Articles Flood Insurance Updates: What You Need to Know in 2024

- Okay, Here’s A Comprehensive Article Predicting And Analyzing The Potential US Inflation Rate In May 2025, Aiming For Approximately 1600 Words.

- National Education Standards: A Cornerstone Of Educational Quality And Equity

- Medicare Drug Price Cap: A Comprehensive Analysis

- Climate Change Legislation: A Global Overview Of Policy Responses

- The Military Recruitment Crisis: Causes, Consequences, And Potential Solutions

Introduction

We will be happy to explore interesting topics related to Flood Insurance Updates: What You Need to Know in 2024. Let’s knit interesting information and provide new insights to readers.

Table of Content

Flood Insurance Updates: What You Need to Know in 2024

Flooding is one of the most common and costly natural disasters in the United States. With climate change contributing to rising sea levels and more extreme weather events, the risk of flooding is only increasing. For homeowners, renters, and business owners, understanding flood insurance is more critical than ever. This article provides a comprehensive overview of the latest flood insurance updates, focusing on changes to the National Flood Insurance Program (NFIP), private flood insurance options, risk assessment, and practical steps you can take to protect your property and finances.

The National Flood Insurance Program (NFIP): A Cornerstone of Flood Protection

Established in 1968, the NFIP is the primary source of flood insurance in the United States. Administered by the Federal Emergency Management Agency (FEMA), the NFIP aims to reduce the impact of flooding on private and public property by providing affordable insurance to property owners and by encouraging communities to adopt and enforce floodplain management regulations.

Key Features of the NFIP:

- Availability: The NFIP is available in over 23,000 communities across the country that have agreed to adopt and enforce floodplain management regulations.

- Coverage Limits: The NFIP offers coverage up to $250,000 for residential buildings and $100,000 for personal property. For commercial properties, the coverage limits are $500,000 for the building and $500,000 for contents.

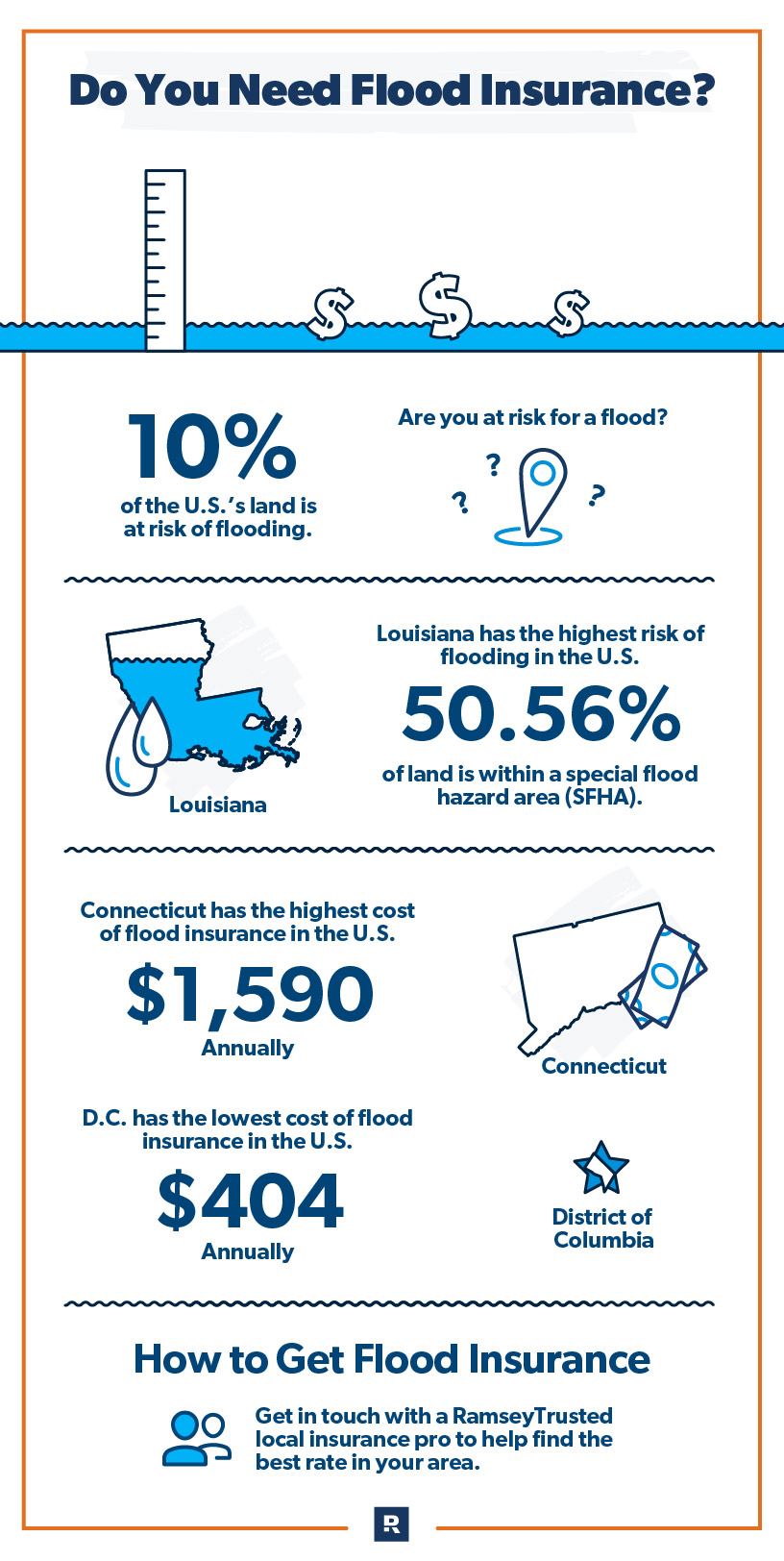

- Mandatory Purchase Requirement: Federal law mandates that property owners in high-risk flood zones (Special Flood Hazard Areas or SFHAs) with mortgages from federally regulated or insured lenders must purchase flood insurance.

- Community Rating System (CRS): The CRS is a voluntary incentive program that recognizes and encourages community floodplain management activities that exceed the minimum NFIP requirements. In CRS communities, policyholders can receive discounted flood insurance rates.

Recent Changes and Updates to the NFIP

The NFIP has undergone significant changes in recent years, primarily driven by the need to modernize the program and ensure its financial sustainability. One of the most impactful changes is the implementation of Risk Rating 2.0.

Risk Rating 2.0: Equity in Action

Risk Rating 2.0 is a new methodology for calculating flood insurance premiums that was implemented by FEMA in April 2022 for new policies and renewals. The primary goal of Risk Rating 2.0 is to provide a more accurate and equitable assessment of flood risk, leading to premiums that better reflect the actual risk of flooding for individual properties.

Key Changes Under Risk Rating 2.0:

- Expanded Data Sources: Risk Rating 2.0 utilizes a broader range of data sources and advanced modeling techniques to assess flood risk. In addition to traditional flood zone maps, it considers factors such as:

- Distance to a water source

- Elevation of the property

- Cost to rebuild

- Types of flood (river overflow, storm surge, coastal erosion, heavy rainfall)

- Individualized Risk Assessment: Instead of relying solely on flood zone maps, Risk Rating 2.0 assesses the unique characteristics of each property to determine its flood risk. This means that properties within the same flood zone may have different premiums based on their specific risk factors.

- Elimination of Pre-FIRM Subsidies: Previously, some properties built before the adoption of Flood Insurance Rate Maps (FIRMs) received subsidized premiums. Risk Rating 2.0 eliminates these subsidies, leading to premium increases for some policyholders.

- Premium Caps: To mitigate the impact of premium increases, FEMA has implemented caps on annual premium increases. By law, premiums cannot increase by more than 18% per year.

Impact of Risk Rating 2.0:

The implementation of Risk Rating 2.0 has had a mixed impact on policyholders. Some property owners are seeing significant premium increases, while others are experiencing decreases. The overall goal is to ensure that premiums accurately reflect the risk of flooding and that the NFIP remains financially solvent.

Private Flood Insurance: An Alternative to the NFIP

In addition to the NFIP, private flood insurance is becoming an increasingly popular option for property owners. Private flood insurance companies offer policies that may provide broader coverage, higher coverage limits, and more flexible terms than the NFIP.

Advantages of Private Flood Insurance:

- Higher Coverage Limits: Private insurers often offer coverage limits that exceed the NFIP’s limits, which can be beneficial for owners of high-value properties.

- Broader Coverage: Some private policies may offer coverage for additional expenses, such as loss of use, living expenses, or basement finishings, which are not typically covered by the NFIP.

- Faster Claims Processing: Private insurers may have faster claims processing times than the NFIP, which can be crucial for homeowners who need to repair or rebuild their properties quickly after a flood.

- Competitive Pricing: In some cases, private flood insurance may be more affordable than the NFIP, particularly for properties that are not located in high-risk flood zones.

Disadvantages of Private Flood Insurance:

- Availability: Private flood insurance may not be available in all areas, particularly in high-risk flood zones.

- Financial Stability: It’s essential to choose a private insurer with a strong financial rating to ensure that they can pay out claims in the event of a major flood.

- Policy Variations: Private flood insurance policies can vary significantly in terms of coverage, exclusions, and deductibles. It’s crucial to carefully review the policy terms before purchasing coverage.

Choosing Between the NFIP and Private Flood Insurance

The best option for flood insurance depends on your individual circumstances, including your property’s location, risk factors, coverage needs, and budget. Here are some factors to consider:

- Flood Zone: If your property is located in a high-risk flood zone and you have a mortgage from a federally regulated lender, you may be required to purchase flood insurance through the NFIP.

- Coverage Needs: If you need higher coverage limits or broader coverage than the NFIP offers, private flood insurance may be a better option.

- Cost: Compare quotes from both the NFIP and private insurers to determine which option is more affordable.

- Policy Terms: Carefully review the policy terms of both the NFIP and private policies to understand the coverage, exclusions, and deductibles.

Assessing Your Flood Risk

Understanding your property’s flood risk is the first step in protecting yourself from flood damage. Here are some ways to assess your flood risk:

- Check Flood Maps: FEMA provides online flood maps that show the location of flood zones in your area. You can access these maps on the FEMA website or through your local government.

- Review Past Flood Events: Research the history of flooding in your area to understand the frequency and severity of past flood events.

- Consult with a Floodplain Manager: Your local floodplain manager can provide information about flood risks in your area and recommend measures to protect your property.

- Obtain an Elevation Certificate: An elevation certificate provides information about your property’s elevation relative to the base flood elevation (BFE). This information can be used to determine your flood risk and calculate your flood insurance premium.

Steps to Protect Your Property from Flooding

In addition to purchasing flood insurance, there are several steps you can take to protect your property from flooding:

- Elevate Your Home: If your home is located in a high-risk flood zone, consider elevating it above the base flood elevation.

- Install Flood Vents: Flood vents allow floodwater to enter and exit your foundation, reducing the pressure on your walls and preventing structural damage.

- Seal Foundation Cracks: Seal any cracks in your foundation to prevent water from entering your basement.

- Install a Sump Pump: A sump pump can remove water from your basement, preventing flooding and water damage.

- Landscape Strategically: Slope the ground away from your foundation to direct water away from your home.

- Protect Utilities: Elevate or protect your utilities, such as your furnace, water heater, and electrical panel, to prevent damage from flooding.

- Create a Flood Emergency Plan: Develop a plan for what to do in the event of a flood, including evacuation routes, communication strategies, and procedures for protecting your property.

The Future of Flood Insurance

The future of flood insurance is likely to be shaped by several factors, including climate change, technological advancements, and policy reforms. As sea levels rise and extreme weather events become more frequent, the risk of flooding is expected to increase, which will put pressure on the NFIP and the private flood insurance market.

Technological advancements, such as improved flood modeling and risk assessment tools, will play a crucial role in helping insurers and property owners better understand and manage flood risk. Policy reforms, such as Risk Rating 2.0, are aimed at ensuring that flood insurance premiums accurately reflect the risk of flooding and that the NFIP remains financially sustainable.

Conclusion

Flood insurance is an essential tool for protecting your property and finances from the devastating effects of flooding. Whether you choose to purchase flood insurance through the NFIP or a private insurer, it’s crucial to understand your flood risk, assess your coverage needs, and take steps to protect your property from flooding. By staying informed about the latest flood insurance updates and taking proactive measures, you can safeguard your home, your business, and your financial future.

Pingback: LGBTQ+ Rights Under Fire In Several States: A Wave Of Legislation Sparks Concern – DAYLI NEWS