“Jobless Claims Hit Record Low: A Deep Dive into the US Labor Market’s Resilience

Related Articles Jobless Claims Hit Record Low: A Deep Dive into the US Labor Market’s Resilience

- EU Nations Push For Renewed Trade Deal With The U.S.: A Quest For Economic Resilience And Geopolitical Alignment

- Federal Reserve Interest Rates: A Comprehensive Overview

- Tech Lobbying Transparency: Shining A Light On Influence And Shaping The Future

- The U.S. Unemployment Rate: An In-Depth Analysis

- Laura Loomer And Trump Affair

Introduction

With great enthusiasm, let’s explore interesting topics related to Jobless Claims Hit Record Low: A Deep Dive into the US Labor Market’s Resilience. Let’s knit interesting information and provide new insights to readers.

Table of Content

Jobless Claims Hit Record Low: A Deep Dive into the US Labor Market’s Resilience

In a remarkable display of economic strength, the United States labor market has defied expectations, with initial jobless claims plummeting to levels not seen in over half a century. This unprecedented milestone, marked by the lowest number of Americans filing for unemployment benefits in decades, signals a robust and resilient labor market that continues to defy predictions of a looming recession.

The Headline: Jobless Claims Plunge to Historic Lows

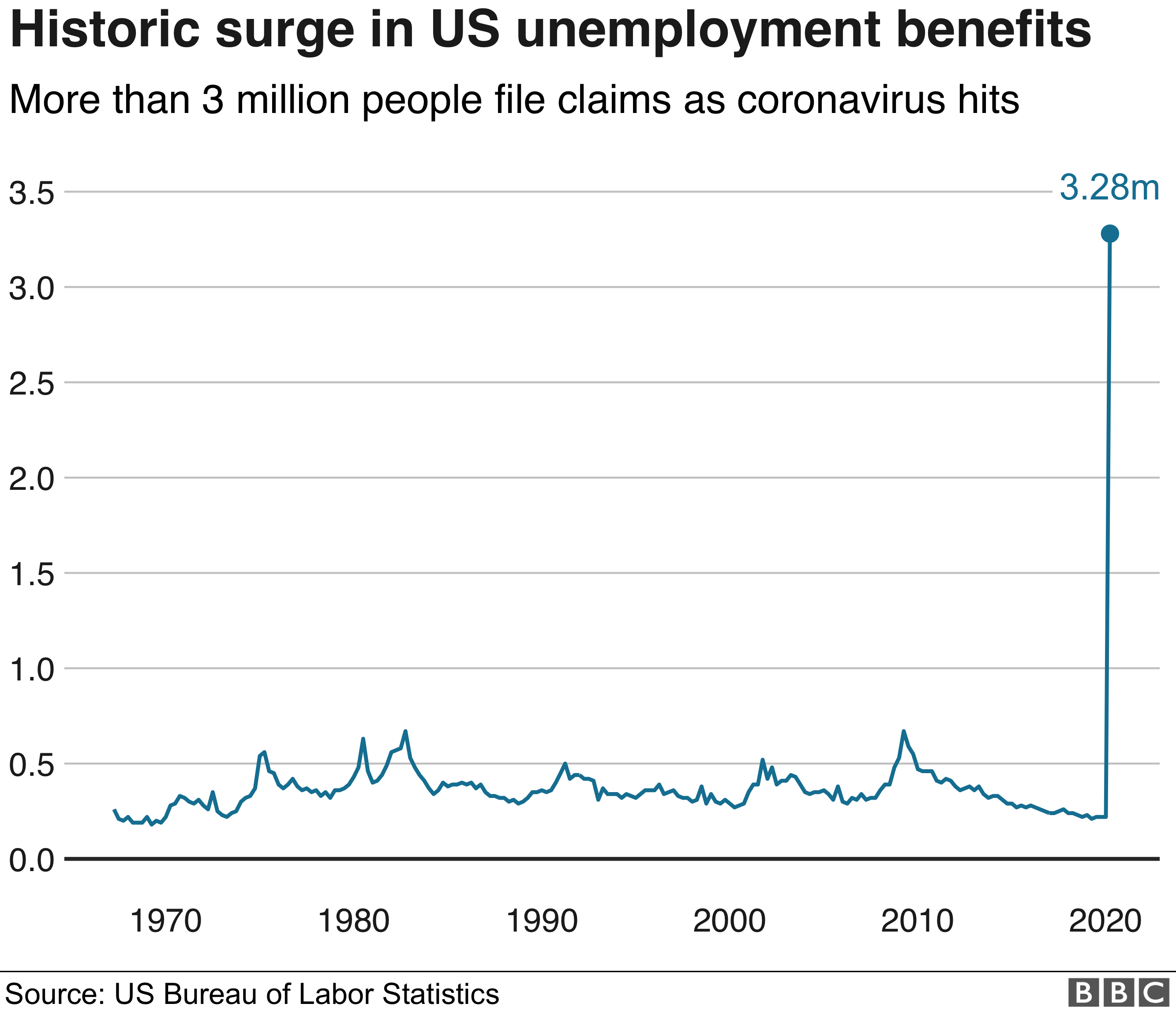

The latest data released by the Department of Labor reveals a staggering decline in initial jobless claims, reaching a historic low that has sent ripples of optimism throughout the economic landscape. The number of Americans filing for unemployment benefits for the first time has plummeted to levels not witnessed since the late 1960s, a testament to the enduring strength of the US labor market.

This significant milestone underscores the remarkable recovery of the labor market from the depths of the COVID-19 pandemic. As businesses reopen, consumer demand surges, and economic activity accelerates, employers are scrambling to attract and retain workers, leading to a sharp decrease in layoffs and an increase in job security.

Understanding Jobless Claims: A Key Economic Indicator

Jobless claims, also known as unemployment claims, serve as a crucial indicator of the health and stability of the labor market. These claims represent the number of individuals who have recently lost their jobs and are seeking unemployment benefits from the government.

Initial jobless claims, in particular, provide a timely snapshot of the current state of the labor market. A decrease in initial jobless claims suggests that fewer people are losing their jobs, indicating a strong and stable labor market. Conversely, an increase in initial jobless claims may signal potential economic weakness or a slowdown in hiring.

Factors Driving the Decline in Jobless Claims

Several factors have contributed to the remarkable decline in jobless claims, painting a comprehensive picture of the forces shaping the US labor market:

-

Strong Economic Growth: The US economy has demonstrated remarkable resilience, rebounding strongly from the COVID-19 pandemic. As economic activity accelerates, businesses are expanding, creating new jobs, and reducing the need for layoffs.

-

Increased Consumer Demand: Consumer spending has surged in recent months, fueled by pent-up demand and government stimulus measures. This surge in demand has led to increased production and hiring, further bolstering the labor market.

-

Labor Shortages: The US labor market is currently experiencing significant labor shortages, with employers struggling to find qualified workers to fill open positions. This shortage has made employers more reluctant to lay off existing employees, further contributing to the decline in jobless claims.

-

Industry-Specific Factors: Certain industries, such as hospitality, leisure, and tourism, have experienced a particularly strong rebound in recent months. As these industries recover, they are rehiring workers who were previously laid off, further reducing the number of jobless claims.

-

Government Support Programs: Government support programs, such as extended unemployment benefits and the Paycheck Protection Program (PPP), have played a significant role in supporting workers and businesses during the pandemic. These programs have helped to prevent widespread layoffs and maintain stability in the labor market.

Implications of Record-Low Jobless Claims

The record-low jobless claims have far-reaching implications for the US economy, signaling a period of sustained growth and stability:

-

Strong Labor Market: The decline in jobless claims confirms that the US labor market is exceptionally strong, with employers actively hiring and retaining workers. This strength is a positive sign for overall economic growth and stability.

-

Increased Job Security: As jobless claims decline, workers can feel more secure in their jobs, knowing that the risk of layoffs is reduced. This increased job security can lead to higher consumer confidence and spending, further boosting the economy.

-

Wage Growth: With employers competing for a limited pool of workers, wages are likely to increase. This wage growth can improve the financial well-being of workers and stimulate consumer spending.

-

Reduced Unemployment Rate: The decline in jobless claims is likely to lead to a further reduction in the unemployment rate, which is already at a historic low. A lower unemployment rate indicates a healthier economy with more people employed and contributing to economic growth.

-

Inflationary Pressures: While a strong labor market is generally positive, it can also contribute to inflationary pressures. As wages increase, businesses may need to raise prices to cover their increased labor costs. The Federal Reserve will need to carefully monitor inflation and adjust monetary policy accordingly.

Challenges and Considerations

While the record-low jobless claims are undoubtedly positive news, it is essential to acknowledge the challenges and considerations that lie ahead:

-

Labor Force Participation Rate: Despite the strong labor market, the labor force participation rate remains below pre-pandemic levels. This suggests that some workers have not yet returned to the labor force, potentially due to factors such as childcare challenges, health concerns, or early retirement.

-

Skills Mismatch: A significant skills mismatch exists in the labor market, with employers struggling to find workers with the specific skills they need. This mismatch can lead to unfilled job openings and slower economic growth.

-

Inflationary Pressures: As mentioned earlier, a strong labor market can contribute to inflationary pressures. The Federal Reserve will need to carefully manage monetary policy to prevent inflation from spiraling out of control.

-

Global Economic Uncertainty: The global economic outlook remains uncertain, with potential risks such as geopolitical tensions, supply chain disruptions, and the spread of new COVID-19 variants. These risks could potentially impact the US labor market.

-

Inequality: While the labor market has improved for many Americans, inequality remains a significant concern. Some workers, particularly those with lower skills and education levels, may not be benefiting as much from the economic recovery.

Expert Opinions and Analysis

Economists and market analysts have offered various perspectives on the record-low jobless claims:

-

Optimistic View: Some economists believe that the decline in jobless claims is a sign of a fundamentally strong and resilient US economy. They argue that the labor market is well-positioned to continue growing in the coming months and years.

-

Cautious View: Other economists are more cautious, pointing to the challenges mentioned above, such as the labor force participation rate, skills mismatch, and inflationary pressures. They argue that the labor market recovery is not yet complete and that risks remain.

-

Data-Driven View: Many analysts emphasize the importance of focusing on the data and closely monitoring key economic indicators, such as jobless claims, unemployment rate, wage growth, and inflation. They believe that a data-driven approach is essential for understanding the true state of the labor market and making informed decisions.

Conclusion: A Resilient Labor Market Poised for Continued Growth

The record-low jobless claims represent a significant milestone in the US labor market’s recovery from the COVID-19 pandemic. This achievement underscores the resilience and strength of the American economy and signals a period of sustained growth and stability.

While challenges and considerations remain, the overall outlook for the labor market is positive. As businesses continue to expand, consumer demand remains strong, and the economy continues to grow, the US labor market is well-positioned to continue creating jobs and opportunities for American workers.

The Federal Reserve will need to carefully monitor inflation and adjust monetary policy accordingly to ensure that the economic recovery remains sustainable. Policymakers should also focus on addressing the challenges of labor force participation, skills mismatch, and inequality to ensure that all Americans can benefit from the strong labor market.

The record-low jobless claims are a testament to the hard work and resilience of American workers and businesses. As the US economy continues to recover and grow, the labor market is poised to play a leading role in driving economic prosperity and opportunity for all.