“Michael Saylor’s Bitcoin Strategy: A Deep Dive into Corporate Adoption and the Future of Finance

Related Articles Michael Saylor’s Bitcoin Strategy: A Deep Dive into Corporate Adoption and the Future of Finance

- Comprehensive Endpoint Threat Intelligence: Protect Your Devices

- Advanced Behavioral Threat Detection: Uncover Lurking Cyber Threats

- Ultimate Guide to Endpoint Breach Detection for Unstoppable Cybersecurity

- Cyber Breach Response: A Comprehensive Guide to Protecting Your Organization

- Stablecoin Regulation Vote: A Watershed Moment For Digital Finance

Introduction

On this special occasion, we are happy to review interesting topics related to Michael Saylor’s Bitcoin Strategy: A Deep Dive into Corporate Adoption and the Future of Finance. Come on knit interesting information and provide new insights to readers.

Table of Content

Michael Saylor’s Bitcoin Strategy: A Deep Dive into Corporate Adoption and the Future of Finance

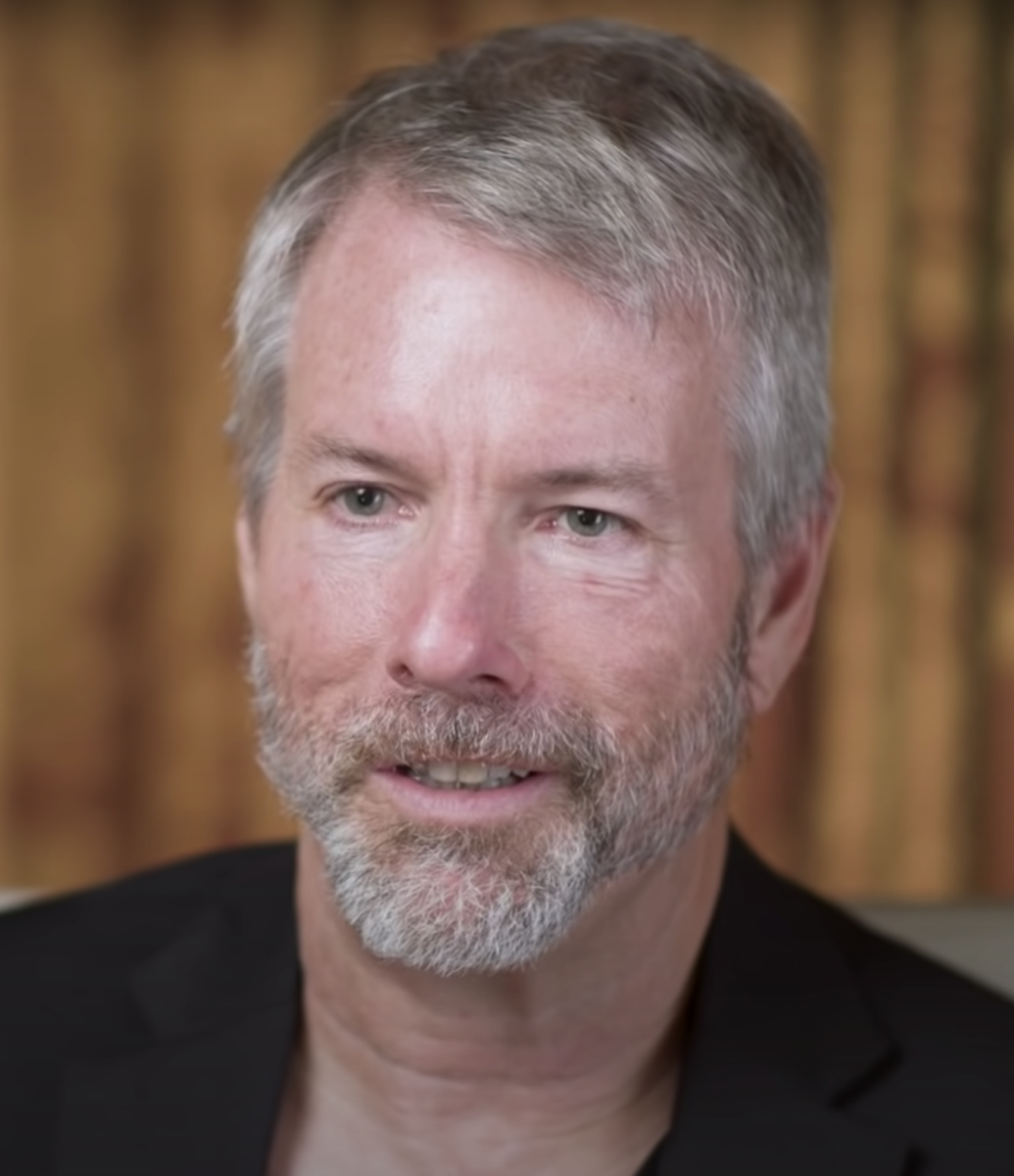

Michael Saylor, the Chairman and former CEO of MicroStrategy, has become one of the most prominent and vocal proponents of Bitcoin. His conviction in the cryptocurrency’s potential as a store of value and a hedge against inflation has led to MicroStrategy adopting a unique and bold strategy: accumulating Bitcoin as its primary treasury reserve asset. This strategy has not only transformed MicroStrategy but has also influenced other companies and individuals to consider Bitcoin as a viable alternative to traditional assets.

The Genesis of the Bitcoin Strategy

Before diving into the specifics of MicroStrategy’s Bitcoin strategy, it’s essential to understand the context that led Saylor to embrace Bitcoin. In 2020, Saylor and his team at MicroStrategy grew increasingly concerned about the eroding value of cash reserves due to inflation and low-interest rates. They recognized that holding large amounts of cash was essentially a losing proposition, as its purchasing power diminished over time.

Saylor and his team began exploring alternative investment options that could preserve and grow the company’s capital. After extensive research and analysis, they concluded that Bitcoin offered the most compelling solution. Bitcoin’s limited supply, decentralized nature, and potential for long-term appreciation made it an attractive alternative to traditional assets like cash, bonds, and even gold.

MicroStrategy’s Initial Investment and Subsequent Acquisitions

In August 2020, MicroStrategy made its first significant investment in Bitcoin, purchasing 21,454 BTC for an aggregate purchase price of $250 million. This initial investment marked a pivotal moment for both MicroStrategy and the broader cryptocurrency market. It signaled that a publicly traded company was willing to allocate a substantial portion of its treasury reserves to Bitcoin.

Following the initial investment, MicroStrategy continued to accumulate Bitcoin aggressively. The company employed various strategies to acquire more Bitcoin, including:

- Using excess cash flow: MicroStrategy allocated a portion of its free cash flow to purchase Bitcoin regularly.

- Issuing debt: The company raised capital through debt offerings specifically to purchase Bitcoin. This strategy allowed MicroStrategy to leverage its balance sheet to acquire more Bitcoin than it could have with cash alone.

- Equity offerings: MicroStrategy also issued equity to raise capital for Bitcoin purchases.

As of September 2023, MicroStrategy holds approximately 158,245 Bitcoins, acquired for about $4.68 billion at an average price of $29,582 per Bitcoin. This makes MicroStrategy one of the largest corporate holders of Bitcoin globally.

Rationale Behind the Bitcoin Strategy

Saylor has articulated several reasons for MicroStrategy’s Bitcoin strategy:

- Store of Value: Saylor views Bitcoin as a superior store of value compared to traditional assets like cash and gold. He argues that Bitcoin’s limited supply of 21 million coins makes it inherently scarce and resistant to inflation.

- Hedge Against Inflation: With governments around the world printing money to stimulate their economies, Saylor believes that Bitcoin offers a hedge against the devaluation of fiat currencies.

- Digital Gold: Saylor often refers to Bitcoin as "digital gold," emphasizing its potential to serve as a safe-haven asset in times of economic uncertainty.

- Long-Term Investment: MicroStrategy’s Bitcoin strategy is not a short-term speculation. Saylor has stated that the company intends to hold its Bitcoin for the long term, viewing it as a strategic asset that will appreciate in value over time.

- Catalyst for Innovation: Saylor believes that Bitcoin will drive innovation in various industries, including finance, technology, and energy.

Impact on MicroStrategy’s Stock Price

MicroStrategy’s Bitcoin strategy has had a significant impact on its stock price. Initially, the market reacted positively to the company’s Bitcoin investments, with the stock price soaring as Bitcoin’s price increased. However, the stock price has also been volatile, mirroring the fluctuations in the price of Bitcoin.

Some analysts have argued that MicroStrategy’s stock has become a proxy for Bitcoin, meaning that its price is heavily influenced by Bitcoin’s performance. While this may be true to some extent, it’s important to note that MicroStrategy’s underlying business operations also contribute to its overall value.

Criticisms of the Bitcoin Strategy

MicroStrategy’s Bitcoin strategy has not been without its critics. Some have raised concerns about the company’s exposure to the volatility of Bitcoin, arguing that it could negatively impact its financial performance. Others have questioned the wisdom of allocating a significant portion of the company’s treasury reserves to a single asset, especially one as speculative as Bitcoin.

- Volatility Risk: Bitcoin’s price is known for its volatility, which could lead to significant fluctuations in MicroStrategy’s balance sheet. A sharp decline in Bitcoin’s price could result in impairment charges and negatively impact the company’s earnings.

- Concentration Risk: Allocating a large portion of treasury reserves to a single asset exposes MicroStrategy to concentration risk. If Bitcoin’s price were to collapse, the company’s financial health could be severely affected.

- Opportunity Cost: By investing heavily in Bitcoin, MicroStrategy may be missing out on other investment opportunities that could generate higher returns.

- Regulatory Risk: The regulatory landscape for cryptocurrencies is still evolving, and there is a risk that future regulations could negatively impact Bitcoin’s price and MicroStrategy’s investment.

Saylor’s Response to Criticism

Saylor has consistently defended MicroStrategy’s Bitcoin strategy, arguing that the potential benefits outweigh the risks. He believes that Bitcoin’s long-term appreciation potential makes it a worthwhile investment, even if it experiences short-term volatility.

Saylor has also emphasized that MicroStrategy has a strong balance sheet and can withstand fluctuations in Bitcoin’s price. He has stated that the company is committed to holding its Bitcoin for the long term and is not concerned about short-term price movements.

Influence on Other Companies and Individuals

MicroStrategy’s Bitcoin strategy has influenced other companies and individuals to consider Bitcoin as an investment. Several other publicly traded companies, such as Tesla and Square, have added Bitcoin to their balance sheets. Additionally, many individuals have been inspired by Saylor’s advocacy and have invested in Bitcoin.

Saylor’s vocal support for Bitcoin has helped to legitimize the cryptocurrency and bring it into the mainstream. He has become a leading voice in the Bitcoin community, educating people about its potential and advocating for its adoption.

The Future of MicroStrategy’s Bitcoin Strategy

It is likely that MicroStrategy will continue to hold and potentially increase its Bitcoin holdings in the future. Saylor remains a staunch advocate for Bitcoin and believes that its value will continue to appreciate over time.

MicroStrategy’s Bitcoin strategy could also evolve in the future. The company may explore new ways to leverage its Bitcoin holdings, such as using them as collateral for loans or participating in decentralized finance (DeFi) activities.

Conclusion

Michael Saylor’s Bitcoin strategy has been a bold and transformative move for MicroStrategy. While it has faced criticism and carries inherent risks, it has also positioned the company as a leader in the cryptocurrency space and has influenced other companies and individuals to consider Bitcoin as an investment.

Whether MicroStrategy’s Bitcoin strategy will ultimately be successful remains to be seen. However, it has undoubtedly sparked a conversation about the role of Bitcoin in the future of finance and has solidified Michael Saylor’s position as one of the most influential figures in the cryptocurrency world. His conviction and unwavering commitment to Bitcoin have made him a key voice in shaping the narrative around digital assets and their potential to disrupt traditional financial systems. Only time will tell if his vision will fully materialize, but his impact on the adoption and understanding of Bitcoin is undeniable.