“No Tax on Tips Act Passed by Senate: A Boon for Service Industry Workers

Related Articles No Tax on Tips Act Passed by Senate: A Boon for Service Industry Workers

- Google’s AI Revolution: From Search To Sentience (and Everything In Between)

- Samson Mow: The Architect Of Bitcoin’s Narrative, One Tweet At A Time

- Telemedicine Adoption: Revolutionizing Healthcare Delivery In The Digital Age

- Unifying Threat Intelligence for Enhanced Cybersecurity

- The Midwest Tornado Outbreak: A Chronicle Of Devastation And Resilience

Introduction

We will be happy to explore interesting topics related to No Tax on Tips Act Passed by Senate: A Boon for Service Industry Workers. Come on knit interesting information and provide new insights to readers.

Table of Content

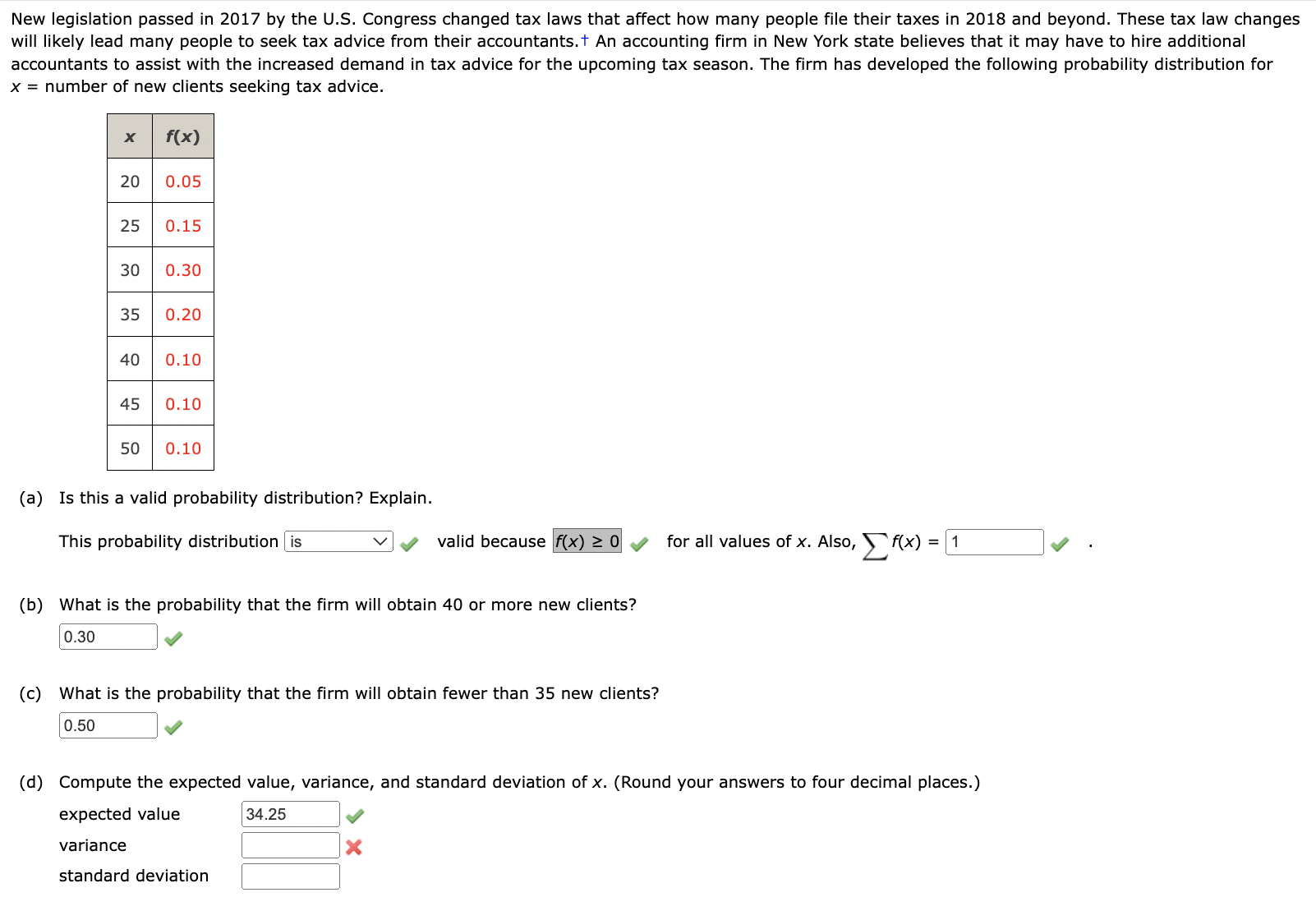

No Tax on Tips Act Passed by Senate: A Boon for Service Industry Workers

In a significant victory for service industry workers across the United States, the Senate has recently passed the No Tax on Tips Act. This bipartisan legislation aims to provide tax relief to individuals who earn income through tips, a crucial component of their overall earnings. The bill’s passage marks a crucial step toward easing the financial burdens faced by millions of service industry employees and simplifying the tax process for both workers and employers.

Background

Tips are a customary form of gratuity provided by customers to service industry workers, such as waiters, bartenders, hairdressers, and delivery drivers, in recognition of their service. For many of these workers, tips constitute a substantial portion of their income, often supplementing relatively low base wages. However, tips are considered taxable income by the Internal Revenue Service (IRS), requiring workers to report and pay taxes on their tip earnings.

The process of reporting and paying taxes on tips can be complex and burdensome for service industry workers. Many individuals may not be fully aware of their tax obligations or may struggle to accurately track and report their tip income. This can lead to unintentional errors, underreporting, and potential penalties from the IRS.

Key Provisions of the No Tax on Tips Act

The No Tax on Tips Act seeks to address these challenges by providing a tax exemption for a certain amount of tip income earned by service industry workers. The specific details of the exemption may vary, but the general intent is to reduce the tax burden on tip income, thereby increasing the take-home pay of service industry employees.

The bill typically includes provisions that:

- Exempt a certain amount of tip income from federal income taxes.

- Simplify the reporting process for tip income.

- Provide resources and education to service industry workers on tax compliance.

Benefits of the No Tax on Tips Act

The passage of the No Tax on Tips Act is expected to bring several benefits to service industry workers and the broader economy:

-

Increased Take-Home Pay: By exempting a portion of tip income from taxation, the bill will directly increase the take-home pay of service industry workers. This additional income can help workers meet their basic needs, cover unexpected expenses, and improve their overall financial well-being.

-

Reduced Tax Burden: The bill will alleviate the tax burden on service industry workers, making it easier for them to manage their finances and comply with their tax obligations. This can reduce stress and anxiety associated with tax filing and minimize the risk of errors and penalties.

-

Simplified Tax Process: The bill may include provisions to simplify the reporting process for tip income, making it easier for workers to accurately track and report their earnings. This can save time and effort and reduce the likelihood of errors.

-

Economic Stimulus: By increasing the disposable income of service industry workers, the bill can stimulate economic activity. Workers are more likely to spend their additional income on goods and services, which can boost demand and create jobs.

-

Fairness and Equity: The bill can promote fairness and equity in the tax system by recognizing the unique circumstances of service industry workers who rely on tips as a significant source of income. It can help ensure that these workers are not disproportionately burdened by taxes.

Support and Opposition

The No Tax on Tips Act has garnered support from a wide range of stakeholders, including:

-

Service Industry Workers: Service industry workers are the primary beneficiaries of the bill and overwhelmingly support its passage. They believe that the bill will provide much-needed financial relief and simplify the tax process.

-

Labor Unions: Labor unions representing service industry workers have actively lobbied for the passage of the bill. They argue that the bill is essential to protecting the rights and interests of their members.

-

Business Associations: Some business associations representing restaurants, hotels, and other service-oriented businesses also support the bill. They believe that the bill will help attract and retain workers in the service industry.

-

Bipartisan Group of Legislators: The No Tax on Tips Act has attracted bipartisan support from legislators in both the House and Senate. This reflects a growing recognition of the need to address the challenges faced by service industry workers.

However, the bill has also faced some opposition from certain groups:

-

Tax Policy Experts: Some tax policy experts have raised concerns about the potential cost of the bill and its impact on the federal budget. They argue that the bill could create a loophole that allows some individuals to avoid paying their fair share of taxes.

-

Fiscal Conservatives: Some fiscal conservatives have opposed the bill on the grounds that it is fiscally irresponsible and could lead to increased government debt. They argue that the bill should be offset by spending cuts or tax increases elsewhere in the budget.

Impact on the Service Industry

The passage of the No Tax on Tips Act is expected to have a significant impact on the service industry:

-

Attracting and Retaining Workers: The bill can help attract and retain workers in the service industry by making it more financially attractive to work in these jobs. This can help address labor shortages and improve the quality of service.

-

Boosting Employee Morale: The bill can boost employee morale by providing workers with a sense of financial security and recognition for their hard work. This can lead to increased productivity and improved customer service.

-

Leveling the Playing Field: The bill can help level the playing field between service industry workers and other workers who do not rely on tips as a source of income. It can help ensure that service industry workers are not disproportionately burdened by taxes.

-

Promoting Economic Growth: By increasing the disposable income of service industry workers, the bill can promote economic growth in the service sector and the broader economy.

Conclusion

The passage of the No Tax on Tips Act by the Senate represents a significant victory for service industry workers across the United States. This bipartisan legislation aims to provide tax relief to individuals who earn income through tips, a crucial component of their overall earnings. The bill’s passage marks a crucial step toward easing the financial burdens faced by millions of service industry employees and simplifying the tax process for both workers and employers.

The No Tax on Tips Act is expected to bring several benefits to service industry workers and the broader economy, including increased take-home pay, reduced tax burden, simplified tax process, economic stimulus, and fairness and equity. While the bill has faced some opposition, it has garnered support from a wide range of stakeholders, including service industry workers, labor unions, business associations, and a bipartisan group of legislators.

The passage of the No Tax on Tips Act is expected to have a significant impact on the service industry, including attracting and retaining workers, boosting employee morale, leveling the playing field, and promoting economic growth. This legislation is a testament to the importance of recognizing the contributions of service industry workers and providing them with the support they need to thrive.

Disclaimer: This article is for informational purposes only and does not constitute legal or tax advice. Consult with a qualified professional for advice tailored to your specific situation.