“Rising Insurance Premiums: Understanding the Drivers and Navigating the Impact

Related Articles Rising Insurance Premiums: Understanding the Drivers and Navigating the Impact

- Wildfire Season In California: A State In Flames

- Essential Endpoint Security Management: Protect Your Network from Cyber Threats

- AI Regulation In The US: A Landscape In Formation

- AI In National Defense: Revolutionizing Warfare And Raising Ethical Dilemmas

- Ultimate Endpoint Protection: Shielding Your Network from Cyber Threats

Introduction

On this special occasion, we are happy to review interesting topics related to Rising Insurance Premiums: Understanding the Drivers and Navigating the Impact. Let’s knit interesting information and provide new insights to readers.

Table of Content

Rising Insurance Premiums: Understanding the Drivers and Navigating the Impact

Insurance is a cornerstone of modern financial planning, providing a safety net against unforeseen events that could otherwise lead to devastating financial losses. From health and auto coverage to homeowners and life insurance, these policies offer peace of mind and crucial protection. However, in recent years, many individuals and businesses have faced a concerning trend: steadily rising insurance premiums. This article delves into the multifaceted reasons behind escalating insurance costs, explores the impact on policyholders, and offers strategies for navigating this challenging landscape.

The Anatomy of Insurance Premiums

To understand why premiums are rising, it’s essential to grasp the fundamental factors that determine how insurers calculate these costs. Insurance premiums are essentially the price policyholders pay for the financial protection provided by an insurance policy. Insurers assess risk, estimate potential payouts, and factor in operational expenses to arrive at a premium amount. Here’s a breakdown of the key components that influence insurance premiums:

-

Risk Assessment: At the heart of insurance is the concept of risk. Insurers evaluate the likelihood of an insured event occurring, such as an accident, illness, natural disaster, or death. This assessment involves analyzing historical data, statistical models, and individual risk factors. For example, a young driver with a history of speeding tickets will face higher auto insurance premiums than an experienced driver with a clean record. Similarly, a homeowner in an area prone to hurricanes will likely pay more for property insurance.

-

Claims History: Past claims experience significantly impacts premiums. If an individual or a group of policyholders has a history of frequent or costly claims, insurers are likely to raise premiums to cover the increased risk. This is because a higher claims history suggests a greater probability of future claims.

-

Coverage Limits and Deductibles: The extent of coverage and the deductible amount also play a crucial role in determining premiums. Higher coverage limits provide more extensive protection but come at a higher cost. Conversely, a higher deductible – the amount the policyholder pays out of pocket before insurance kicks in – typically results in lower premiums.

-

Operational Costs: Insurers have operational expenses to cover, including salaries, administrative costs, marketing, and technology investments. These costs are factored into premiums to ensure the insurer’s financial stability and ability to pay out claims.

-

Investment Income: Insurers invest the premiums they collect to generate income. The returns from these investments can help offset claims payouts and operational costs, potentially influencing premium levels. However, when investment returns are low, insurers may need to rely more on premiums to meet their financial obligations.

-

Regulatory Environment: Insurance is heavily regulated by government agencies to protect consumers and ensure the solvency of insurance companies. Regulations can impact premium levels by mandating certain coverage requirements, setting standards for risk assessment, and influencing pricing practices.

Drivers of Rising Insurance Premiums

Several factors have contributed to the recent surge in insurance premiums across various sectors. These drivers are often interconnected and can vary in their impact depending on the specific type of insurance and geographic location.

-

Increased Frequency and Severity of Claims: One of the primary drivers of rising premiums is the increasing frequency and severity of claims. This trend is evident in several areas:

-

Natural Disasters: Climate change has led to more frequent and intense natural disasters, such as hurricanes, wildfires, floods, and droughts. These events cause widespread damage, resulting in massive insurance payouts. Insurers must raise premiums to cover these escalating losses and maintain their financial stability.

-

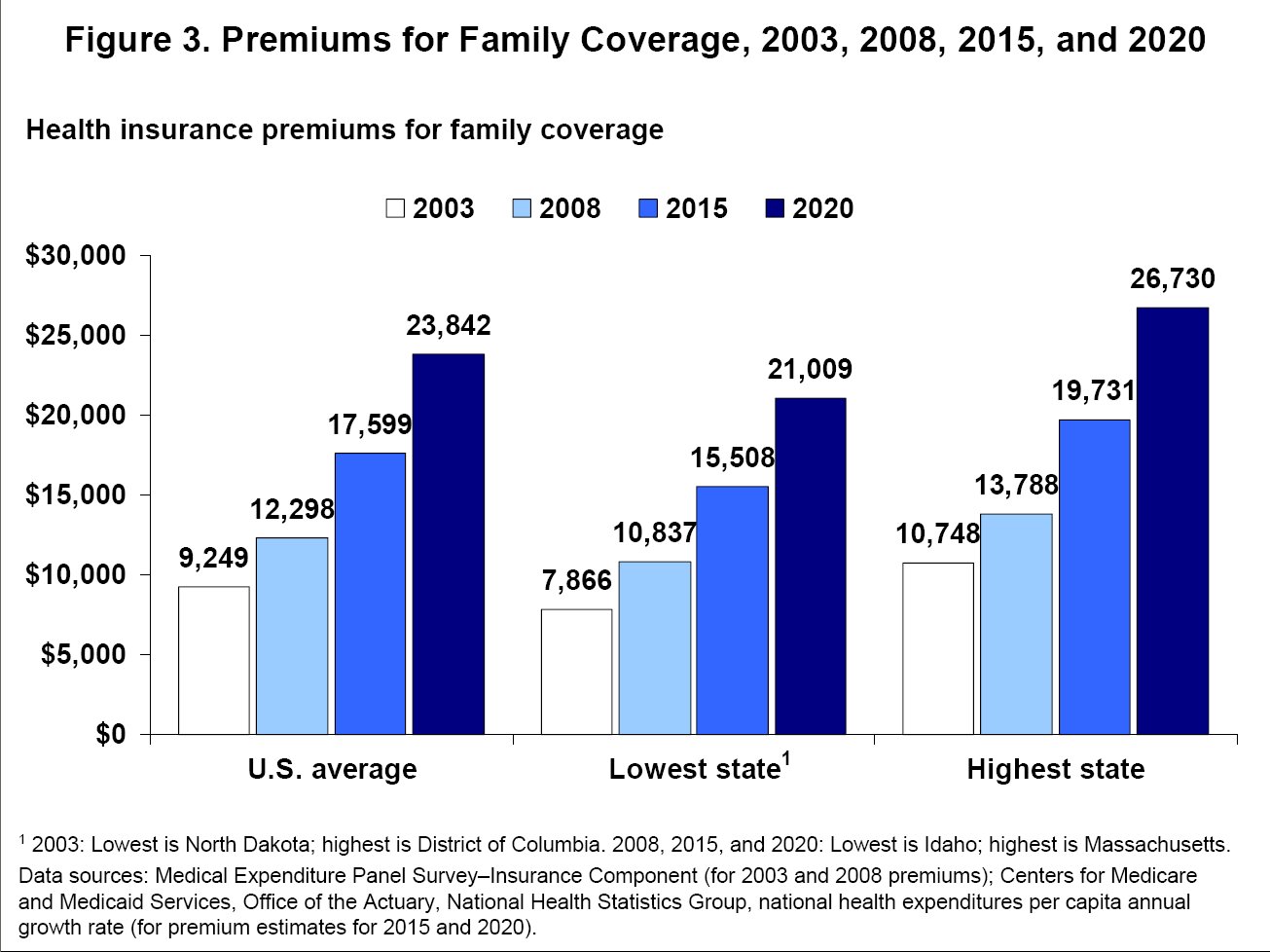

Healthcare Costs: The cost of healthcare continues to rise, driven by factors such as technological advancements, an aging population, and increasing demand for specialized treatments. As healthcare costs increase, health insurance premiums also rise to cover these expenses.

-

Auto Accidents: Distracted driving, speeding, and other risky behaviors contribute to a high number of auto accidents. The cost of repairing vehicles, medical expenses for injuries, and legal settlements all drive up auto insurance claims and, consequently, premiums.

-

Cyberattacks: With the increasing reliance on technology, cyberattacks have become more frequent and sophisticated. Data breaches, ransomware attacks, and other cyber incidents can result in significant financial losses for businesses, leading to higher cyber insurance premiums.

-

-

Economic Factors: Economic conditions can also influence insurance premiums.

-

Inflation: Inflation affects the cost of goods and services, including those related to insurance claims. For example, if the cost of repairing a car or rebuilding a home increases due to inflation, insurers will need to pay out more for claims, leading to higher premiums.

-

Interest Rates: Interest rates impact insurers’ investment income. When interest rates are low, insurers may earn less from their investments, requiring them to rely more on premiums to cover their obligations.

-

Supply Chain Disruptions: Disruptions to the supply chain can increase the cost of materials and labor needed to repair or replace damaged property. These increased costs translate into higher insurance claims and, ultimately, higher premiums.

-

-

Regulatory Changes: Changes in insurance regulations can also impact premiums.

-

Mandated Coverage: Regulations that require insurers to cover certain types of treatments or services can increase premiums, as insurers must factor in the cost of providing this coverage.

-

Risk-Based Capital Requirements: Regulations that require insurers to hold a certain amount of capital based on their risk profile can also influence premiums. Insurers may need to raise premiums to meet these capital requirements.

-

-

Social and Legal Trends: Social and legal trends can also contribute to rising insurance premiums.

-

Litigation: An increase in lawsuits and legal settlements can drive up insurance claims and premiums. Insurers may need to raise premiums to cover the cost of defending against lawsuits and paying out settlements.

-

Social Inflation: Social inflation refers to the rising cost of insurance claims due to changing social attitudes and perceptions. This can include factors such as increased sympathy for plaintiffs in lawsuits, a greater willingness to award large settlements, and a perception that corporations have deep pockets.

-

Impact on Policyholders

Rising insurance premiums can have a significant impact on individuals, families, and businesses.

-

Financial Strain: Higher premiums can strain household budgets and business finances, making it more difficult to afford essential coverage. This can lead to individuals and businesses reducing coverage levels or foregoing insurance altogether, leaving them vulnerable to financial losses.

-

Reduced Coverage: To offset the impact of rising premiums, some policyholders may choose to reduce their coverage limits or increase their deductibles. While this can lower premiums in the short term, it also means that policyholders will have less protection in the event of a claim.

-

Business Competitiveness: Rising insurance premiums can make it more difficult for businesses to compete, especially small businesses with limited resources. Higher insurance costs can reduce profitability and make it more challenging to invest in growth.

-

Healthcare Access: Rising health insurance premiums can make it more difficult for individuals and families to access healthcare. Some may choose to go without insurance or delay seeking medical care, which can have serious health consequences.

Navigating the Landscape of Rising Premiums

While rising insurance premiums can be daunting, there are strategies that policyholders can use to mitigate the impact and ensure they have adequate coverage at a reasonable cost.

-

Shop Around: It’s essential to shop around and compare quotes from multiple insurers. Premiums can vary significantly between companies, so it pays to do your research and find the best deal.

-

Review Coverage Needs: Regularly review your coverage needs to ensure you have the right amount of protection. Consider whether you can reduce coverage limits or increase deductibles without compromising your financial security.

-

Improve Risk Profile: Take steps to improve your risk profile. For example, install safety features in your home, maintain a good driving record, and adopt healthy lifestyle habits. These actions can lower your risk of filing a claim and potentially reduce your premiums.

-

Bundle Policies: Many insurers offer discounts for bundling multiple policies, such as auto and homeowners insurance. Bundling can save you money and simplify your insurance management.

-

Take Advantage of Discounts: Ask your insurer about available discounts. Many insurers offer discounts for things like being a loyal customer, having a good credit score, or being a member of certain organizations.

-

Work with an Independent Agent: An independent insurance agent can help you compare quotes from multiple insurers and find the best coverage for your needs. Independent agents are not tied to a single insurance company, so they can provide unbiased advice.

-

Consider Telematics: Some auto insurers offer telematics programs that track your driving behavior. If you’re a safe driver, you may be able to earn discounts on your premiums.

-

Stay Informed: Stay informed about trends in the insurance industry and factors that are driving up premiums. This knowledge can help you make informed decisions about your coverage and navigate the changing landscape.

Conclusion

Rising insurance premiums are a growing concern for individuals and businesses alike. Factors such as increased frequency and severity of claims, economic conditions, regulatory changes, and social trends are all contributing to this trend. While rising premiums can strain budgets and reduce coverage, policyholders can take steps to mitigate the impact. By shopping around, reviewing coverage needs, improving risk profiles, and working with insurance professionals, individuals and businesses can navigate the landscape of rising premiums and ensure they have adequate protection at a reasonable cost. As the insurance industry continues to evolve, staying informed and proactive will be crucial for managing insurance costs effectively.