“Startups See Funding Dip Amid Market Uncertainty

Related Articles Startups See Funding Dip Amid Market Uncertainty

- Mariska Hargitay Opens Up About Jayne Mansfield’s Legacy In Powerful New Documentary

- Three New Rocky Exoplanets Detected Around Barnard’s Star: A Revolution In The Search For Habitable Worlds?

- Elon Musk Ends Alliance With Trump Over Tax Legislation

- Apple Unveils IPhone 16e, Officially Discontinues Lightning Port Models

- Singapore’s PAP Wins Landslide In 2025 General Election: A Nation Endorses Continuity Amidst Change

Introduction

With great enthusiasm, let’s explore interesting topics related to Startups See Funding Dip Amid Market Uncertainty. Come on knit interesting information and provide new insights to readers.

Startups See Funding Dip Amid Market Uncertainty

The startup ecosystem, once a seemingly unstoppable force of innovation and rapid growth, is now facing a stark reality check. After years of unprecedented venture capital (VC) investment, fueled by low interest rates and a seemingly insatiable appetite for disruptive technologies, the funding landscape is undergoing a significant shift. Market uncertainty, driven by factors such as rising inflation, geopolitical tensions, and fears of a recession, is causing investors to become more cautious and selective, leading to a noticeable dip in funding for startups across various sectors.

The Boom and the Bust: A Look Back

To understand the current situation, it’s crucial to remember the recent past. The period from 2020 to early 2022 witnessed an unprecedented boom in startup funding. The COVID-19 pandemic, while devastating in many ways, also accelerated the adoption of digital technologies, creating fertile ground for startups in areas like e-commerce, remote work, and digital health. Governments around the world injected massive amounts of stimulus into the economy, further fueling the surge in liquidity. This combination of factors led to a frenzy of VC investment, with valuations soaring to dizzying heights.

Startups, flush with cash, were able to pursue aggressive growth strategies, often prioritizing market share over profitability. The "growth at all costs" mentality became prevalent, as companies focused on acquiring users and expanding rapidly, even if it meant burning through significant amounts of capital. This environment also fostered a culture of high employee salaries and generous perks, as startups competed fiercely for talent.

However, the tide began to turn in late 2021 and early 2022. Inflation started to rise sharply, prompting central banks to raise interest rates. The war in Ukraine added further uncertainty to the global economy, disrupting supply chains and driving up energy prices. As a result, investors began to reassess their risk appetite and became more cautious about deploying capital.

The Current Landscape: A Cooling-Off Period

The impact of this shift is now being felt across the startup ecosystem. Funding rounds are becoming smaller and more difficult to close. Valuations are coming down, often significantly, as investors demand more favorable terms. Startups that were once highly sought after are now finding it harder to attract funding, and many are being forced to make difficult decisions, such as laying off employees or scaling back their growth plans.

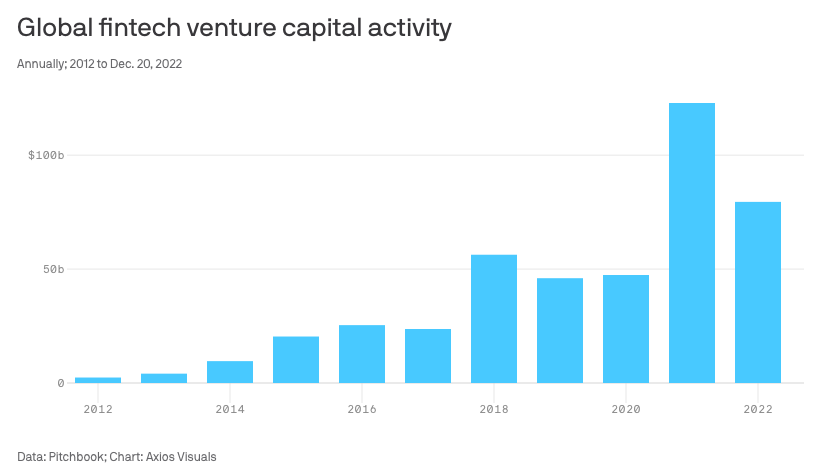

According to data from various sources, including Crunchbase, PitchBook, and CB Insights, global venture funding has declined significantly in recent quarters. The number of mega-rounds (funding rounds of $100 million or more) has also decreased, indicating that investors are becoming more selective about the types of companies they are willing to back with large sums of money.

Several factors are contributing to this cooling-off period:

- Rising Interest Rates: As interest rates rise, the cost of capital increases, making it more expensive for investors to borrow money to invest in startups. This reduces the amount of capital available for venture funding.

- Inflation: High inflation erodes consumer purchasing power and increases the cost of doing business, making it more difficult for startups to achieve profitability. This makes investors more cautious about investing in companies that are not yet generating significant revenue.

- Geopolitical Uncertainty: The war in Ukraine and other geopolitical tensions have created a climate of uncertainty, making investors more risk-averse. Investors are less likely to invest in companies that are exposed to geopolitical risks.

- Recession Fears: The growing fear of a recession is also contributing to the slowdown in startup funding. If the economy enters a recession, consumer spending is likely to decline, which would negatively impact the growth prospects of many startups.

- Public Market Performance: The performance of tech stocks in the public market has a direct impact on the private market. When tech stocks are struggling, it creates a negative sentiment and dampens investor enthusiasm for startups. Many high-profile tech companies have seen their valuations plummet in recent months, which has further contributed to the slowdown in startup funding.

Impact on Different Sectors

While the funding dip is affecting startups across various sectors, some are being hit harder than others. Companies in sectors that are particularly sensitive to economic downturns, such as consumer discretionary and real estate, are facing greater challenges in raising capital. Startups that are heavily reliant on advertising revenue are also feeling the pinch, as marketing budgets are often among the first to be cut during times of economic uncertainty.

On the other hand, some sectors are proving to be more resilient. Companies in areas such as cybersecurity, healthcare, and enterprise software are still attracting significant investment, as these sectors are considered to be more essential and less discretionary. Startups that are addressing critical needs or solving pressing problems are more likely to weather the storm.

Strategies for Startups in a Downturn

In this challenging environment, startups need to adapt their strategies in order to survive and thrive. Here are some key strategies that startups should consider:

- Focus on Profitability: The "growth at all costs" mentality is no longer viable. Startups need to prioritize profitability and demonstrate a clear path to sustainable revenue generation. This may involve cutting costs, increasing prices, or focusing on higher-margin products or services.

- Extend Runway: Startups should focus on extending their cash runway as much as possible. This may involve raising additional capital, even at a lower valuation, or reducing expenses. The goal is to have enough cash on hand to weather the downturn and continue operating until the funding environment improves.

- Conserve Cash: Startups should be extremely careful about how they spend their money. Every dollar should be scrutinized and allocated to the most essential activities. Non-essential expenses should be cut or eliminated.

- Focus on Core Business: Startups should focus on their core business and avoid distractions. Now is not the time to experiment with new products or services. Instead, focus on improving the existing product and serving existing customers.

- Strengthen Customer Relationships: Customer retention is more important than ever. Startups should focus on building strong relationships with their customers and providing them with excellent service. Happy customers are more likely to stick around during tough times.

- Be Transparent with Investors: Startups should be transparent with their investors about the challenges they are facing and the steps they are taking to address them. Honest and open communication is essential for maintaining investor confidence.

- Explore Alternative Funding Sources: In addition to traditional venture capital, startups should explore alternative funding sources, such as debt financing, revenue-based financing, or government grants.

- Be Prepared to Pivot: If the startup’s original business model is no longer viable, it may be necessary to pivot to a new business model. This is a difficult decision, but it may be necessary for survival.

The Silver Lining

While the current funding dip is undoubtedly challenging for startups, it also presents some opportunities. A more disciplined funding environment can force startups to become more efficient and focused. It can also weed out weaker companies and allow stronger companies to emerge.

Furthermore, the current downturn may create opportunities for strategic acquisitions. Larger companies may be looking to acquire startups with promising technologies or talented teams at discounted prices.

Looking Ahead

It is difficult to predict how long the current funding dip will last. However, most experts believe that the market will eventually recover. When it does, the startup ecosystem is likely to be more mature and sustainable. Startups that have successfully navigated the downturn will be well-positioned to thrive in the future.

In the meantime, startups need to be prepared to weather the storm. By focusing on profitability, extending runway, and conserving cash, they can increase their chances of survival and emerge stronger on the other side. The key is to adapt, innovate, and remain resilient in the face of adversity. The startups that can do this will be the ones that ultimately succeed in the long run. The current market conditions are a test of resilience, and those who pass will be the leaders of tomorrow.