“The Crushing Weight of College Tuition Inflation: Understanding the Causes, Consequences, and Potential Solutions

Related Articles The Crushing Weight of College Tuition Inflation: Understanding the Causes, Consequences, and Potential Solutions

- Master Real-time Threat Response Techniques for Unstoppable Cybersecurity

- World Liberty Financial Scandal: A Cautionary Tale Of Greed And Deceit

- Ultimate Guide to Attack Surface Reduction: Enhancing Cybersecurity Posture

- Essential Threat Response Tools for Robust Cybersecurity

- The U.S. Unemployment Rate: An In-Depth Analysis

Introduction

On this special occasion, we are happy to review interesting topics related to The Crushing Weight of College Tuition Inflation: Understanding the Causes, Consequences, and Potential Solutions. Let’s knit interesting information and provide new insights to readers.

Table of Content

The Crushing Weight of College Tuition Inflation: Understanding the Causes, Consequences, and Potential Solutions

For generations, higher education has been touted as a gateway to upward mobility, a cornerstone of personal and professional development, and a vital engine for economic growth. However, the soaring cost of college tuition in recent decades has cast a long shadow over this once-unquestioned belief. The relentless rise in tuition fees, often outpacing inflation and wage growth, has transformed the pursuit of higher education into a daunting financial burden for countless students and families.

This article delves into the complex phenomenon of college tuition inflation, exploring its multifaceted causes, examining its far-reaching consequences, and considering potential solutions to address this pressing issue.

A Historical Perspective: Tracing the Trajectory of Tuition Inflation

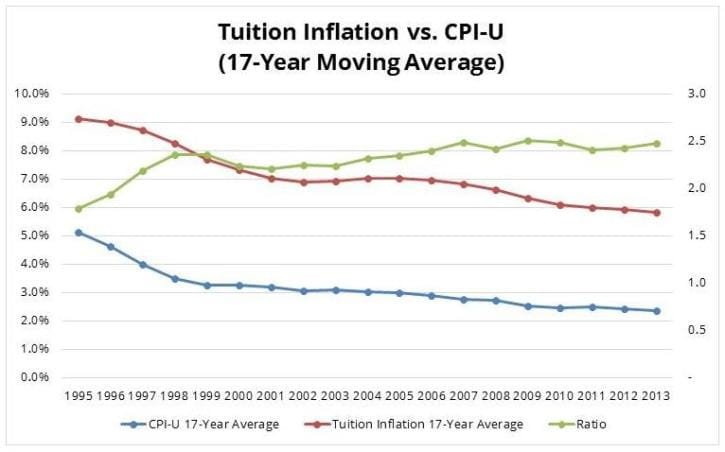

To fully grasp the magnitude of the problem, it’s essential to examine the historical trends in college tuition. In the United States, for example, tuition rates at both public and private institutions have surged dramatically since the 1980s. According to data from the National Center for Education Statistics (NCES), the average cost of tuition, fees, room, and board at public four-year institutions has more than doubled in real terms (adjusted for inflation) over the past four decades. Private nonprofit colleges have experienced a similar, albeit even steeper, increase.

This inflationary trend is not unique to the United States. Many developed countries, including the United Kingdom, Canada, and Australia, have witnessed significant increases in tuition fees in recent years. While the specific drivers may vary across countries, the overall trend suggests a global challenge in maintaining affordable access to higher education.

Unraveling the Causes: A Complex Web of Contributing Factors

The persistent rise in college tuition is not attributable to a single cause but rather a confluence of factors that have collectively fueled inflationary pressures. Some of the key drivers include:

-

Declining State Funding: Public colleges and universities have historically relied on state government funding to subsidize tuition costs. However, over the past few decades, many states have reduced their financial support for higher education, shifting the burden of funding onto students and their families. This decline in state funding is often attributed to competing budgetary priorities, such as healthcare and infrastructure, as well as broader economic challenges.

-

Increased Demand for Higher Education: As the knowledge economy has grown, the demand for higher education has intensified. A college degree is increasingly seen as a prerequisite for many jobs, leading more students to pursue post-secondary education. This increased demand has allowed colleges to raise tuition rates without significantly impacting enrollment.

-

Administrative Bloat and Rising Operational Costs: Some critics argue that colleges have become increasingly bureaucratic and inefficient, with excessive administrative staff and rising operational costs. While some administrative functions are necessary, concerns have been raised about the proliferation of non-academic positions and the lack of cost control measures in many institutions.

-

The "Arms Race" for Prestige: Colleges often engage in an "arms race" to attract top students and faculty by investing in lavish facilities, cutting-edge technology, and other amenities. While these investments can enhance the student experience, they also contribute to rising costs that are ultimately passed on to students through higher tuition fees.

-

Availability of Federal Student Aid: While federal student aid programs like Pell Grants and student loans are intended to make college more accessible, some economists argue that they have inadvertently contributed to tuition inflation. The argument is that colleges, knowing that students have access to federal aid, are more likely to raise tuition rates, capturing some of the benefits of the aid for themselves.

-

Lack of Price Transparency: Many colleges lack transparency in their pricing practices, making it difficult for students and families to understand the true cost of attendance and compare prices across institutions. This lack of transparency can reduce price competition and allow colleges to raise tuition rates without facing significant pushback.

The Consequences: A Ripple Effect of Financial Strain and Inequality

The relentless rise in college tuition has far-reaching consequences for individuals, families, and society as a whole. Some of the most significant impacts include:

-

Increased Student Debt: As tuition rates have soared, students have been forced to borrow larger amounts of money to finance their education. This has led to a student debt crisis, with millions of Americans struggling to repay their loans. High levels of student debt can delay or prevent graduates from achieving other financial goals, such as buying a home, starting a family, or saving for retirement.

-

Reduced Access to Higher Education: The high cost of college can deter qualified students from low- and middle-income families from pursuing higher education. This can perpetuate cycles of poverty and inequality, as those who cannot afford college are less likely to access the economic opportunities that come with a college degree.

-

Skills Gaps and Economic Stagnation: If a significant portion of the population is priced out of higher education, it can lead to skills gaps in the workforce and hinder economic growth. A well-educated workforce is essential for innovation, productivity, and global competitiveness.

-

Delayed Life Milestones: The burden of student debt can delay or prevent graduates from achieving important life milestones, such as getting married, buying a home, or starting a family. This can have broader social and economic consequences, such as lower birth rates and reduced consumer spending.

-

Mental Health Impacts: The stress and anxiety associated with student debt can take a toll on mental health. Studies have shown that students with high levels of debt are more likely to experience depression, anxiety, and other mental health problems.

Potential Solutions: A Multifaceted Approach

Addressing the challenge of college tuition inflation requires a multifaceted approach involving policymakers, institutions, and students. Some potential solutions include:

-

Increased State and Federal Funding: Restoring and increasing state and federal funding for higher education is crucial to reducing the burden on students and families. This could involve increasing taxes, reallocating existing resources, or creating new funding mechanisms.

-

Controlling Administrative Costs: Colleges need to take steps to control administrative costs and improve efficiency. This could involve streamlining administrative processes, reducing non-academic staff, and implementing cost-saving measures.

-

Promoting Price Transparency: Colleges should be required to provide clear and transparent information about tuition costs, fees, and financial aid options. This would allow students and families to make informed decisions about where to attend college.

-

Reforming Federal Student Aid: The federal student aid system needs to be reformed to ensure that it is not contributing to tuition inflation. This could involve capping loan amounts, simplifying the application process, and increasing grant aid for low-income students.

-

Exploring Alternative Funding Models: Colleges should explore alternative funding models, such as income-share agreements, where students pay a percentage of their income after graduation in exchange for tuition assistance.

-

Investing in Community Colleges and Vocational Training: Community colleges and vocational training programs offer affordable pathways to higher education and skilled jobs. Investing in these institutions can help to reduce the demand for four-year colleges and alleviate tuition pressures.

-

Encouraging Innovation in Higher Education: Colleges should embrace innovation in teaching and learning, such as online education and competency-based education, to reduce costs and improve student outcomes.

-

Addressing the "Arms Race" for Prestige: Colleges need to resist the pressure to engage in an "arms race" for prestige and focus on providing a high-quality education at an affordable price.

Conclusion: A Call to Action

The relentless rise in college tuition is a complex and multifaceted problem with far-reaching consequences. Addressing this challenge requires a concerted effort from policymakers, institutions, and students. By increasing funding, controlling costs, promoting transparency, reforming student aid, and encouraging innovation, we can make higher education more affordable and accessible for all.

The future of our society depends on ensuring that everyone has the opportunity to pursue higher education without being burdened by crippling debt. It is time to take bold action to address the crushing weight of college tuition inflation and create a more equitable and prosperous future for all.