“The Looming Pension Fund Shortfall: A Global Crisis in the Making

Related Articles The Looming Pension Fund Shortfall: A Global Crisis in the Making

- The Medicare Drug Price Cap: A Transformative Shift In Healthcare Access And Affordability

- The Contentious Landscape Of Texas Immigration Law

- Early Warning System: Proactive Security Breach Detection for Enhanced Cybersecurity

- Secure Your Digital Realm: Enhanced Threat Detection Solutions

- AI Regulation In The US: A Landscape In Formation

Introduction

We will be happy to explore interesting topics related to The Looming Pension Fund Shortfall: A Global Crisis in the Making. Come on knit interesting information and provide new insights to readers.

Table of Content

The Looming Pension Fund Shortfall: A Global Crisis in the Making

In an era defined by economic uncertainty, demographic shifts, and financial market volatility, the specter of a looming pension fund shortfall casts a long shadow over the financial security of millions worldwide. Pension funds, once considered the bedrock of retirement planning, are increasingly struggling to meet their obligations, leaving retirees and future generations facing the unsettling prospect of reduced benefits or delayed retirement. This article delves into the multifaceted nature of the pension fund shortfall, exploring its causes, consequences, and potential solutions.

Understanding Pension Funds: A Primer

Before delving into the intricacies of the shortfall, it is essential to understand the fundamental workings of pension funds. A pension fund is a financial vehicle designed to accumulate and manage assets to provide retirement income to individuals. These funds operate under various structures, each with its own set of characteristics:

- Defined Benefit (DB) Plans: In a DB plan, employers guarantee a specific level of retirement income to employees based on factors such as salary and years of service. The employer bears the investment risk, ensuring that sufficient funds are available to meet the promised benefits.

- Defined Contribution (DC) Plans: In a DC plan, employees and/or employers contribute regularly to an individual account. The retirement income is dependent on the investment performance of the account. Employees bear the investment risk and have more control over their investment choices.

- Hybrid Plans: These plans combine features of both DB and DC plans, offering a blend of guaranteed benefits and individual account management.

The Anatomy of the Pension Fund Shortfall

The pension fund shortfall arises when the assets held by a pension fund are insufficient to meet its future obligations to retirees. This shortfall can manifest in several ways:

- Underfunding: The most common form of shortfall, where the present value of the fund’s liabilities exceeds its assets.

- Insolvency: A more severe situation where the fund is unable to meet its immediate obligations to retirees.

- Benefit Reductions: A drastic measure where the fund reduces the promised benefits to retirees to align with its available assets.

The Culprits Behind the Shortfall: A Multifaceted Problem

The pension fund shortfall is not a monolithic problem but rather a complex interplay of several factors:

-

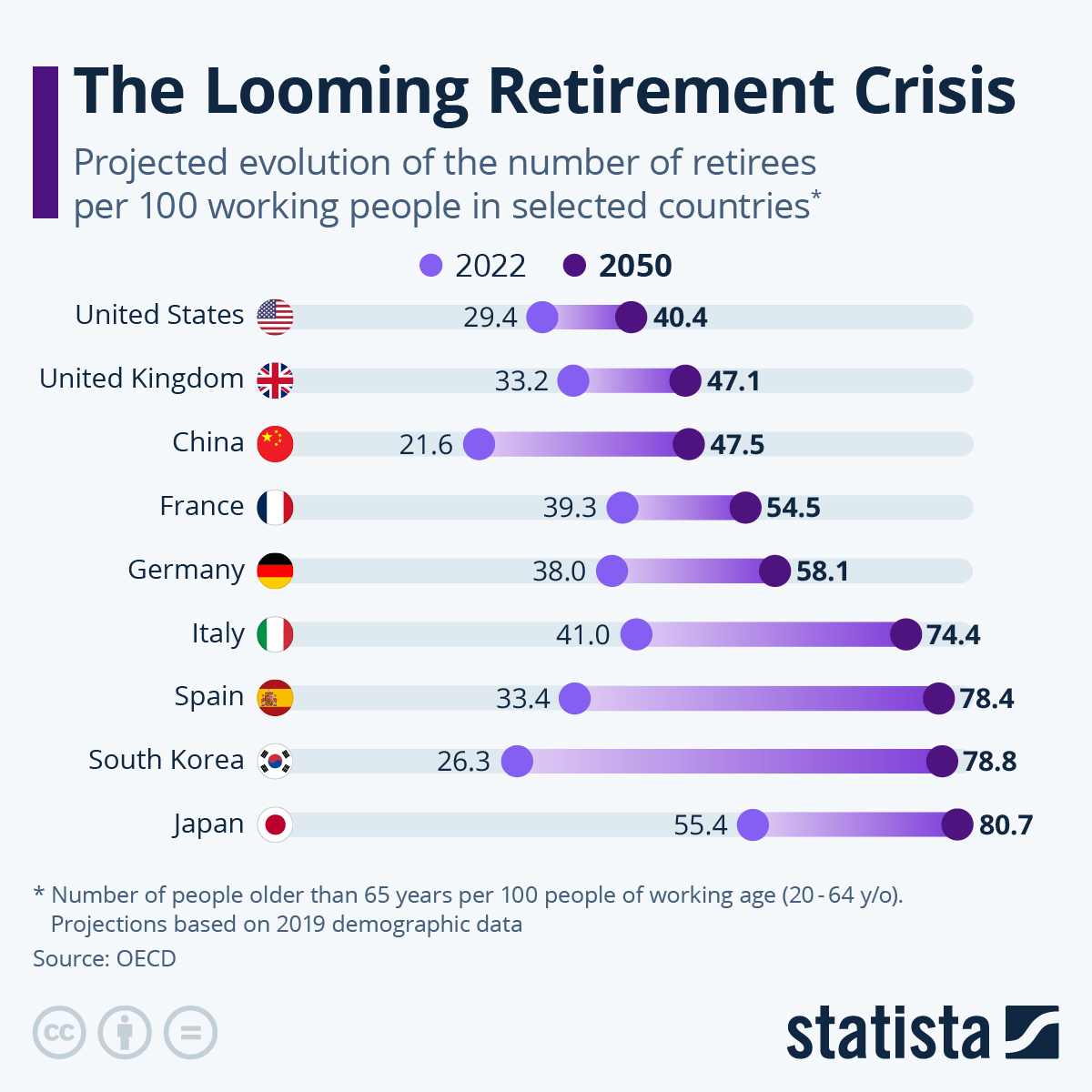

Demographic Shifts: The global population is aging, with birth rates declining and life expectancies increasing. This demographic shift places immense pressure on pension funds, as they must support a growing number of retirees for longer periods. The ratio of workers contributing to the fund versus retirees drawing benefits is shrinking, straining the system’s financial sustainability.

-

Low Interest Rates: The prolonged period of low interest rates following the 2008 financial crisis has significantly impacted pension fund returns. Lower interest rates reduce the returns on fixed-income investments, which constitute a significant portion of pension fund portfolios. This makes it more challenging for funds to meet their return targets and cover their liabilities.

-

Investment Underperformance: Pension funds often rely on investment returns to bridge the gap between contributions and benefit payments. However, volatile financial markets and periods of underperformance can erode asset values, exacerbating the shortfall. Poor investment decisions, excessive risk-taking, or inadequate diversification can also contribute to underperformance.

-

Increased Longevity: As people live longer, pension funds must pay out benefits for a more extended period. This increased longevity adds to the financial burden on pension funds, requiring them to hold larger reserves to meet their long-term obligations.

-

Insufficient Contributions: In some cases, the level of contributions made by employers and employees may be insufficient to meet the projected benefit payments. This can be due to factors such as stagnant wages, declining workforce participation, or inadequate funding policies.

-

Regulatory and Accounting Standards: Changes in regulatory and accounting standards can also impact the reported financial health of pension funds. For example, stricter funding requirements or changes in discount rate assumptions can reveal hidden liabilities and increase the perceived shortfall.

-

Company Bankruptcies and Restructuring: When companies face financial distress or bankruptcy, their pension funds can be severely affected. Underfunded pension plans may be terminated, leaving retirees with reduced benefits or requiring government intervention to cover the shortfall.

The Ripple Effects: Consequences of the Shortfall

The pension fund shortfall has far-reaching consequences, impacting individuals, businesses, and governments:

- Reduced Retirement Income: The most direct consequence is the potential for reduced retirement income for individuals. Retirees may receive lower benefits than they were promised, forcing them to adjust their living standards and postpone retirement plans.

- Increased Retirement Age: To compensate for the shortfall, some individuals may be forced to delay their retirement, working longer to accumulate sufficient savings. This can have implications for workforce dynamics and job opportunities for younger generations.

- Financial Strain on Governments: Governments may be forced to step in and provide financial assistance to struggling pension funds, placing a strain on public finances. This can lead to higher taxes, reduced public services, or increased government debt.

- Economic Instability: A widespread pension fund crisis can trigger economic instability, as retirees reduce their spending and consumer confidence declines. This can lead to a slowdown in economic growth and potentially trigger a recession.

- Erosion of Trust: The pension fund shortfall can erode public trust in financial institutions and retirement systems. This can lead to decreased participation in pension plans and a greater reliance on individual savings, which may not be sufficient for a secure retirement.

- Impact on Businesses: Companies with underfunded pension plans may face higher contribution requirements, reducing their profitability and competitiveness. This can lead to job losses, reduced investment, and potentially even bankruptcy.

Navigating the Crisis: Potential Solutions

Addressing the pension fund shortfall requires a multi-pronged approach involving governments, businesses, and individuals:

- Increasing Contributions: Raising contribution rates for both employers and employees can help to bolster pension fund assets. This may require difficult decisions and potential sacrifices, but it is essential to ensure the long-term sustainability of the system.

- Reforming Benefit Structures: Adjusting benefit structures, such as increasing the retirement age or reducing the level of benefits, can help to align liabilities with available assets. These reforms should be carefully considered to minimize the impact on retirees and future generations.

- Improving Investment Strategies: Pension funds need to adopt more sophisticated investment strategies to generate higher returns while managing risk. This may involve diversifying into alternative asset classes, such as private equity or real estate, and employing active management techniques.

- Strengthening Regulatory Oversight: Governments need to strengthen regulatory oversight of pension funds to ensure that they are adequately funded and managed prudently. This includes setting stricter funding requirements, improving transparency, and holding fund managers accountable for their performance.

- Promoting Financial Literacy: Individuals need to be more financially literate and take greater responsibility for their retirement planning. This includes understanding the risks and rewards of different investment options and making informed decisions about their savings and retirement plans.

- Encouraging Longer Working Lives: Encouraging individuals to work longer can help to reduce the burden on pension funds and increase their retirement savings. This may involve policies such as raising the retirement age or providing incentives for older workers to remain in the workforce.

- Government Intervention: In some cases, government intervention may be necessary to provide financial assistance to struggling pension funds. This can involve providing direct funding, guaranteeing benefits, or restructuring the pension system.

Conclusion: A Call to Action

The pension fund shortfall is a pressing global challenge that demands urgent attention. Without decisive action, the consequences could be severe, impacting the financial security of millions and undermining economic stability. By implementing a combination of the solutions outlined above, governments, businesses, and individuals can work together to navigate this crisis and ensure a more secure retirement for future generations. The time to act is now, before the looming shortfall becomes an irreversible crisis.