“The U.S. Unemployment Rate: A Comprehensive Analysis

Related Articles The U.S. Unemployment Rate: A Comprehensive Analysis

- Stablecoin Regulation Vote: A Pivotal Moment For Digital Assets

- End-to-End Attack Detection for Enhanced Cyber Security

- Power Grid Strain In Texas

- Mastering Incident Response: A Guide to Mitigating Cyber Threats

- The John Woeltz Crypto Torture Case: A Dark Chapter In The Digital Currency Era

Introduction

We will be happy to explore interesting topics related to The U.S. Unemployment Rate: A Comprehensive Analysis. Let’s knit interesting information and provide new insights to readers.

Table of Content

The U.S. Unemployment Rate: A Comprehensive Analysis

The unemployment rate is a vital economic indicator that reflects the health and stability of a nation’s labor market. In the United States, the unemployment rate is closely monitored by economists, policymakers, and the general public as it provides insights into the overall economic conditions and the availability of job opportunities. This article delves into the intricacies of the U.S. unemployment rate, examining its definition, measurement, historical trends, factors influencing it, its impact on the economy, and the policies aimed at addressing unemployment.

Definition and Measurement

The unemployment rate is defined as the percentage of the labor force that is unemployed and actively seeking employment. The labor force includes individuals aged 16 and over who are either employed or unemployed but actively looking for work. Individuals who are not actively seeking employment, such as students, retirees, and those who are discouraged from looking for work, are not considered part of the labor force.

The U.S. Bureau of Labor Statistics (BLS) is responsible for calculating and reporting the unemployment rate on a monthly basis. The BLS conducts two surveys to gather data on employment and unemployment: the Current Population Survey (CPS) and the Current Employment Statistics (CES) survey.

The CPS, also known as the household survey, is a monthly survey of approximately 60,000 households across the United States. It collects information on the labor force status of individuals in the household, including whether they are employed, unemployed, or not in the labor force. The CPS is used to calculate the official unemployment rate, also known as the U-3 unemployment rate.

The CES survey, also known as the establishment survey, is a monthly survey of approximately 144,000 businesses and government agencies, representing about 697,000 individual worksites. It collects information on employment, hours worked, and earnings of employees. The CES survey is used to estimate the total number of jobs in the economy.

Historical Trends

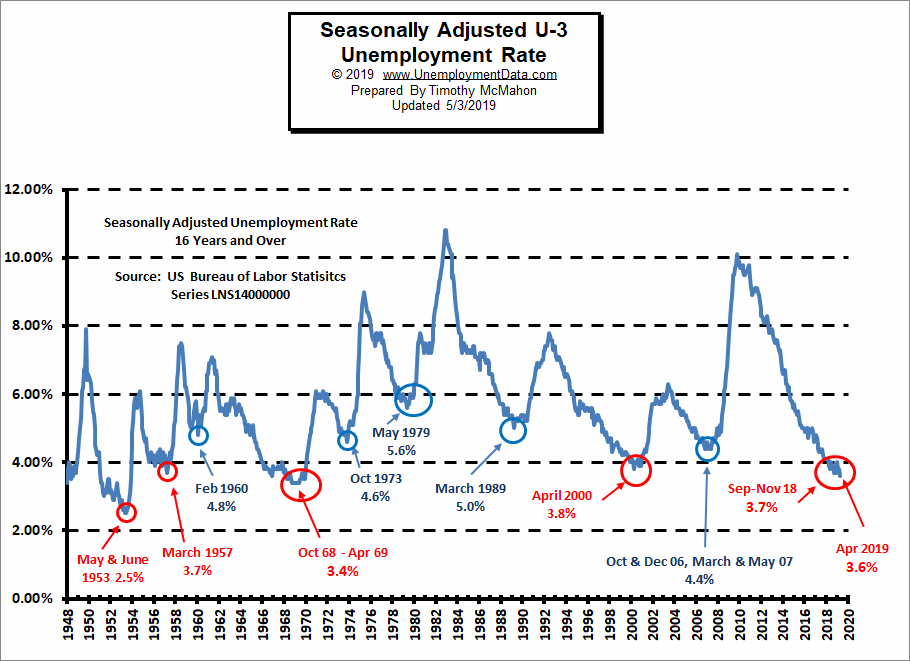

The U.S. unemployment rate has fluctuated significantly over time, reflecting the cyclical nature of the economy. During periods of economic expansion, the unemployment rate tends to decline as businesses hire more workers to meet increasing demand. Conversely, during periods of economic recession, the unemployment rate tends to rise as businesses lay off workers due to declining demand.

In the post-World War II era, the U.S. unemployment rate has ranged from a low of 2.5% in 1953 to a high of 10.8% in 1982. The unemployment rate has also spiked during major economic downturns, such as the 1973-1975 recession, the early 1980s recession, the early 1990s recession, the 2001 recession, and the Great Recession of 2008-2009.

More recently, the U.S. unemployment rate reached a 50-year low of 3.5% in February 2020, just before the onset of the COVID-19 pandemic. However, the pandemic triggered a sharp increase in unemployment, with the rate soaring to 14.8% in April 2020, the highest level since the Great Depression. Since then, the unemployment rate has gradually declined as the economy has recovered, but it remains elevated compared to pre-pandemic levels.

Factors Influencing the Unemployment Rate

Several factors can influence the U.S. unemployment rate, including:

-

Economic Growth: Economic growth is a primary driver of job creation. When the economy is growing, businesses tend to hire more workers to meet increasing demand, leading to a decline in the unemployment rate. Conversely, when the economy is contracting, businesses tend to lay off workers, leading to an increase in the unemployment rate.

-

Monetary Policy: The Federal Reserve (the Fed), the central bank of the United States, can influence the unemployment rate through its monetary policy tools. By lowering interest rates, the Fed can stimulate economic activity, encouraging businesses to invest and hire more workers. Conversely, by raising interest rates, the Fed can slow down economic activity, potentially leading to job losses.

-

Fiscal Policy: The government can also influence the unemployment rate through its fiscal policy tools, such as government spending and taxation. Increased government spending can boost economic activity and create jobs, while tax cuts can stimulate consumer spending and business investment. However, excessive government spending or tax cuts can lead to inflation and other economic problems.

-

Technological Change: Technological advancements can have both positive and negative effects on the unemployment rate. On the one hand, new technologies can create new industries and jobs. On the other hand, they can also automate existing jobs, leading to job losses in certain sectors.

-

Globalization: Globalization, the increasing integration of economies around the world, can also affect the unemployment rate. On the one hand, globalization can create new export opportunities and jobs in industries that compete globally. On the other hand, it can also lead to job losses in industries that face competition from lower-wage countries.

-

Demographic Trends: Demographic trends, such as the aging of the population and changes in labor force participation rates, can also influence the unemployment rate. As the population ages, the labor force participation rate may decline, leading to a higher unemployment rate.

Impact on the Economy

The unemployment rate has a significant impact on the economy. A high unemployment rate can lead to:

-

Reduced Consumer Spending: Unemployed individuals have less disposable income, which can lead to a decline in consumer spending. Consumer spending is a major driver of economic growth, so a decline in consumer spending can slow down the economy.

-

Increased Poverty and Inequality: Unemployment can lead to poverty and income inequality. Unemployed individuals may struggle to meet their basic needs, and they may fall behind on their bills. This can lead to a cycle of poverty and disadvantage.

-

Reduced Tax Revenues: A high unemployment rate can lead to reduced tax revenues for the government. Unemployed individuals do not pay income taxes, and they may also be eligible for government assistance programs, such as unemployment benefits.

-

Social Unrest: High unemployment can lead to social unrest and political instability. Unemployed individuals may become frustrated and angry, and they may participate in protests and other forms of social unrest.

Policies to Address Unemployment

The government can implement various policies to address unemployment, including:

-

Fiscal Stimulus: Fiscal stimulus, such as government spending on infrastructure projects or tax cuts, can boost economic activity and create jobs.

-

Monetary Policy: The Federal Reserve can lower interest rates to stimulate economic activity and encourage businesses to hire more workers.

-

Job Training Programs: Job training programs can help unemployed individuals acquire the skills they need to find jobs in growing industries.

-

Unemployment Benefits: Unemployment benefits can provide temporary income support to unemployed individuals while they search for new jobs.

-

Trade Policies: Trade policies, such as tariffs and trade agreements, can be used to protect domestic industries and jobs from foreign competition.

-

Education Reform: Education reform can help improve the skills and education levels of the workforce, making them more competitive in the global economy.

Conclusion

The U.S. unemployment rate is a critical economic indicator that reflects the health and stability of the labor market. It is influenced by a variety of factors, including economic growth, monetary policy, fiscal policy, technological change, globalization, and demographic trends. The unemployment rate has a significant impact on the economy, affecting consumer spending, poverty, inequality, tax revenues, and social stability. The government can implement various policies to address unemployment, including fiscal stimulus, monetary policy, job training programs, unemployment benefits, trade policies, and education reform. By understanding the complexities of the U.S. unemployment rate, policymakers and individuals can make informed decisions to promote economic growth and improve the lives of American workers.