“US Gas Prices: A Forecast for May 2025

Related Articles US Gas Prices: A Forecast for May 2025

- The John Woeltz Crypto Torture Case: A Dark Chapter In The Digital Currency Era

- Federal Reserve Interest Rates: A Comprehensive Overview

- Essential Threat Response Strategies for Enhanced Cyber Security

- Effective Cyber Defense Strategies for Enhanced Cybersecurity

- Disney Theme Park Expansions: A World Of Endless Possibilities

Introduction

On this special occasion, we are happy to review interesting topics related to US Gas Prices: A Forecast for May 2025. Let’s knit interesting information and provide new insights to readers.

Table of Content

US Gas Prices: A Forecast for May 2025

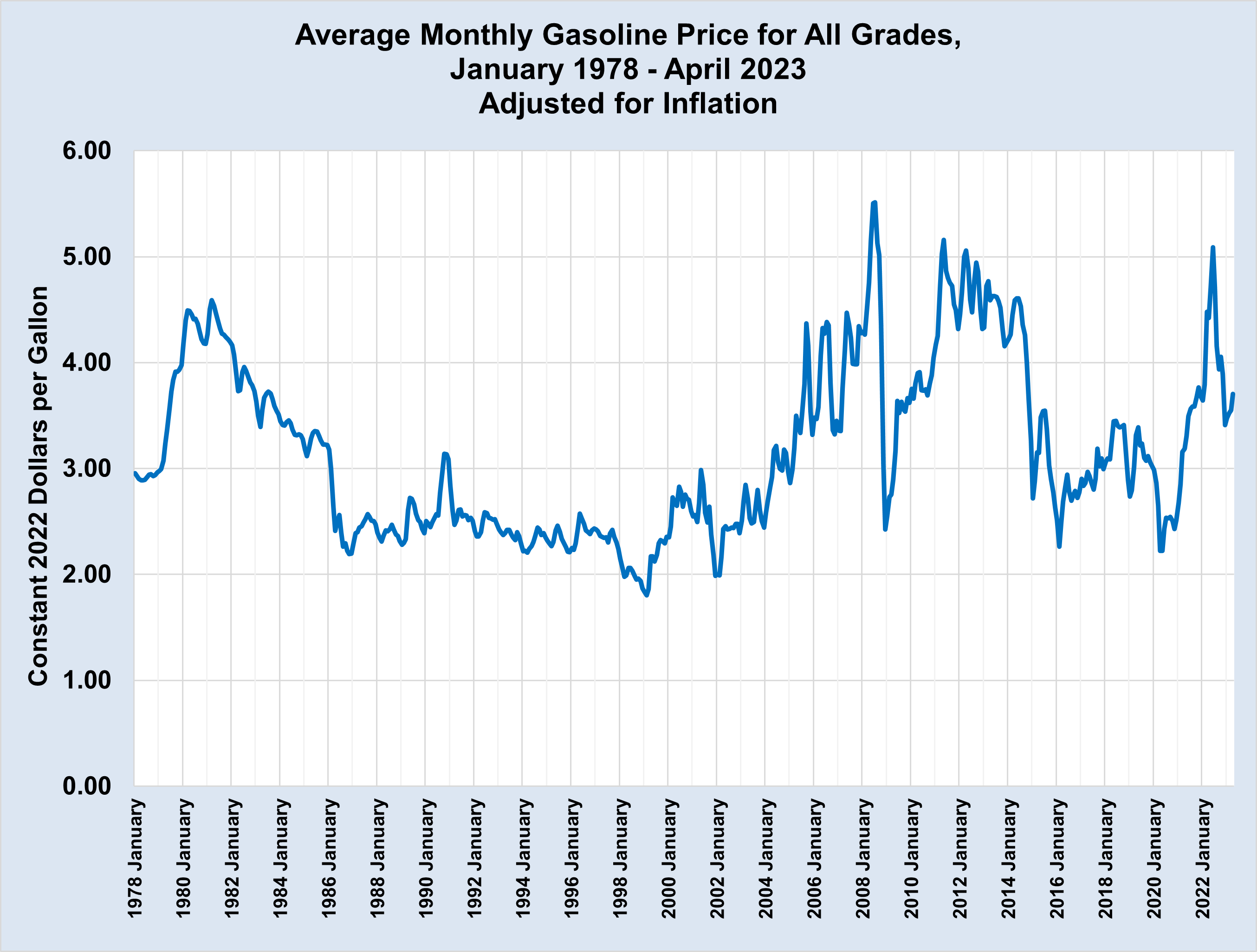

As we look ahead to May 2025, the question of gasoline prices in the United States remains a complex and highly debated topic. Gasoline prices are a significant factor in the American economy, affecting everything from consumer spending to transportation costs. Predicting these prices accurately requires careful consideration of various factors, including global oil markets, geopolitical events, domestic production, and government policies. This article aims to provide a comprehensive forecast for US gas prices in May 2025, examining the key drivers and potential scenarios that could shape the market.

Current Market Dynamics (Late 2024)

Before delving into the forecast for May 2025, it is crucial to understand the current state of the gasoline market in late 2024. Several factors are influencing prices at this time:

-

Global Oil Prices: The price of crude oil, the primary raw material for gasoline, is a dominant factor. In late 2024, oil prices are influenced by a combination of supply constraints from OPEC+ (Organization of the Petroleum Exporting Countries and its allies), geopolitical tensions in key oil-producing regions, and the overall global demand for oil.

-

US Oil Production: Domestic oil production in the United States has been steadily increasing, driven by technological advancements in shale oil extraction. However, production levels are still subject to factors such as regulatory policies, investment decisions, and environmental concerns.

-

Refining Capacity: The capacity of US refineries to process crude oil into gasoline is another critical factor. Refinery outages, maintenance schedules, and regulatory compliance can all impact gasoline supply and, consequently, prices.

-

Demand for Gasoline: Consumer demand for gasoline is influenced by factors such as economic growth, employment rates, and driving habits. Seasonal patterns also play a role, with demand typically increasing during the summer months.

-

Government Policies: Government policies, including taxes, regulations, and energy initiatives, can significantly impact gasoline prices. For example, environmental regulations that mandate the use of cleaner-burning fuels can increase production costs.

-

Geopolitical Factors: Geopolitical instability, such as conflicts or political unrest in oil-producing regions, can disrupt oil supplies and lead to price spikes.

Forecasting Methodology

To forecast gas prices for May 2025, we will employ a combination of methodologies, including:

-

Trend Analysis: Examining historical trends in oil prices, gasoline prices, and related economic indicators to identify patterns and correlations.

-

Supply and Demand Modeling: Developing a model that considers the supply and demand dynamics of the oil and gasoline markets, taking into account factors such as production levels, consumption patterns, and inventory levels.

-

Scenario Analysis: Creating multiple scenarios based on different assumptions about key drivers, such as global economic growth, geopolitical events, and government policies.

-

Expert Opinions: Consulting with industry experts, economists, and analysts to gather insights and perspectives on the future of the gasoline market.

Key Drivers for May 2025

Several key drivers will influence gas prices in May 2025:

-

Global Economic Growth: The pace of global economic growth will have a significant impact on oil demand. Strong economic growth, particularly in emerging markets, could lead to increased demand for oil and higher prices. Conversely, a global economic slowdown could dampen demand and put downward pressure on prices.

-

OPEC+ Production Policies: The production policies of OPEC+ will continue to be a critical factor. If OPEC+ maintains or reduces production levels, it could lead to tighter oil supplies and higher prices. On the other hand, if OPEC+ increases production, it could put downward pressure on prices.

-

US Oil Production: The level of US oil production will also play a crucial role. Increased domestic production could help offset supply constraints from OPEC+ and moderate price increases. However, production levels could be constrained by regulatory policies or investment decisions.

-

Geopolitical Stability: Geopolitical stability in key oil-producing regions is essential for maintaining stable oil supplies. Conflicts or political unrest could disrupt supplies and lead to price spikes.

-

Technological Advancements: Continued advancements in shale oil extraction and other technologies could lead to increased production efficiency and lower costs.

-

Renewable Energy Adoption: The pace of renewable energy adoption, such as electric vehicles (EVs) and renewable fuels, could impact gasoline demand. Increased adoption of EVs could reduce gasoline demand and put downward pressure on prices.

-

Government Regulations and Policies: Government regulations and policies, such as fuel efficiency standards, carbon taxes, and renewable fuel mandates, could significantly impact gasoline prices.

Potential Scenarios for May 2025

Based on the key drivers discussed above, we can outline several potential scenarios for US gas prices in May 2025:

-

Scenario 1: Moderate Growth and Stable Geopolitics (Base Case)

- Global economic growth: Moderate (2-3% annually)

- OPEC+ production: Maintains current levels

- US oil production: Steady increase

- Geopolitical stability: Relatively stable

- Renewable energy adoption: Gradual increase

In this scenario, gas prices in May 2025 are likely to be moderately higher than current levels, driven by increased demand and limited supply growth. The national average price could range from $3.75 to $4.25 per gallon.

-

Scenario 2: Strong Growth and Supply Constraints (Bullish Case)

- Global economic growth: Strong (3-4% annually)

- OPEC+ production: Maintains or reduces levels

- US oil production: Limited growth due to regulations

- Geopolitical instability: Potential disruptions in key regions

- Renewable energy adoption: Slower than expected

In this scenario, strong economic growth and supply constraints could lead to significantly higher gas prices. The national average price could range from $4.50 to $5.00 per gallon or even higher in some regions.

-

Scenario 3: Slow Growth and Increased Production (Bearish Case)

- Global economic growth: Slow (1-2% annually)

- OPEC+ production: Increases production

- US oil production: Significant increase due to technological advancements

- Geopolitical stability: Relatively stable

- Renewable energy adoption: Faster than expected

In this scenario, slow economic growth and increased production could lead to lower gas prices. The national average price could range from $3.25 to $3.75 per gallon.

-

Scenario 4: Geopolitical Crisis (Black Swan Event)

- A major geopolitical crisis, such as a conflict in the Middle East or a significant disruption to oil supplies, could lead to a sharp spike in gas prices. In this scenario, prices could reach $5.00 per gallon or higher in a short period.

Regional Variations

It is important to note that gas prices can vary significantly across different regions of the United States. Factors such as state taxes, transportation costs, and local market conditions can all contribute to these variations. For example, states like California and Hawaii typically have higher gas prices due to higher taxes and stricter environmental regulations.

Impact on Consumers and the Economy

Gas prices have a direct impact on consumers’ wallets and the overall economy. Higher gas prices can lead to:

- Reduced Consumer Spending: Consumers may cut back on discretionary spending to offset higher transportation costs.

- Increased Inflation: Higher gas prices can contribute to overall inflation, as businesses may pass on higher transportation costs to consumers.

- Impact on Transportation Industry: The transportation industry, including trucking and airlines, is particularly vulnerable to fluctuations in gas prices.

- Shift to Fuel-Efficient Vehicles: Higher gas prices may incentivize consumers to purchase more fuel-efficient vehicles, including electric vehicles.

Conclusion

Forecasting gas prices is a challenging task due to the numerous factors that can influence the market. Based on our analysis, gas prices in May 2025 are likely to be moderately higher than current levels in the base case scenario, with a national average price ranging from $3.75 to $4.25 per gallon. However, the actual price could vary significantly depending on global economic growth, OPEC+ production policies, US oil production, geopolitical stability, and other factors. Consumers and businesses should be prepared for potential fluctuations in gas prices and consider strategies to mitigate the impact, such as investing in fuel-efficient vehicles or adopting alternative transportation options.